Quote of the day

Jason Hsu, “Sadly, investors are unmoved by the prospect of earning only a fair return for the risk they take.” (Research Affiliates via @researchpuzzler)

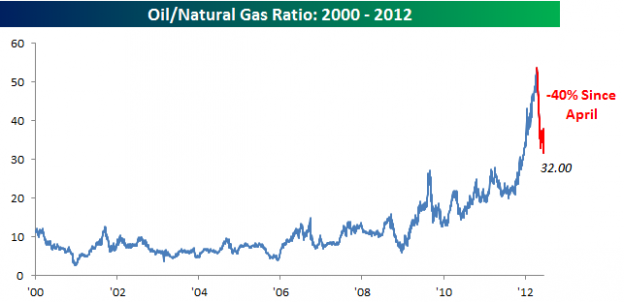

Chart of the day

The oil/natural gas ratio has reversed big time. (Bespoke)

Markets

Why further strength in the Aussie dollar is unlikely. (Market Anthropology)

Sell in May, buy dividend paying stocks. (MarketBeat)

Eddy on the battle between stocks and bonds. (Crossing Wall Street)

Sorting countries by valuation and momentum. (World Beta)

Are utilities played out? (Covestor Blog)

Tops and bottoms

Your market bottom may differ from mine. (Mortality Sucks)

How momentum ends. (Ivanhoff Capital)

Mutual funds

Analyzing unconstrained bond funds is no easy task. (research puzzle pix)

Does mutual fund performance persist? (CXO Advisory Group)

A day in the life of Fidelity fund manager Will Danoff. (Reuters)

Finance

An SEC study shows that money market mutual funds are bailout junkies. (WSJ)

Would Dutch auctions fix the IPO process? (WSJ)

They may find the “god particle” but can they pick hedge funds? (FT)

Hedge fund cheerleaders need a new tune. (AR+Alpha)

ETFs

Will the eventual cap on the Alerian MLP ETN ($AMJ) affect the overall MLP market? (Ari Weinberg also InvestmentNews)

Three ETF charts that tell the story of 2012. (ETFdb)

Is it time to move beyond the large, cap-weighted emerging market index ETFs? (IndexUniverse)

Global

A visual look at the global economic slowdown. (Sober Look)

A lone bull on Greek stocks. (Bloomberg)

Repeated bouts of policy uncertainty is affecting the global economy. (voxEU)

The unlikely origin of the European crisis. (FT Alphaville)

Australia has not been in recession for two decades. (Bloomberg)

Uh oh. Wealthy Asian investors are getting pitched complex, structured products. (WSJ)

Economy

Bad news. Weekly initial unemployment claims high a high for the year. (Calculated Risk, Capital Spectator)

The Philly Fed Index was a big disappointment. (Global Economic Intersection, Money Game, Bespoke)

Just another example of how it is that real estate is local. (Value Plays)

Earlier on Abnormal Returns

What you missed in our Thursday morning linkfest. (Abnormal Returns)

Mixed media

Why Business Insider matters. (24/7 Wall St.)

Is your personal finance app secure? (Total Return)

Eleven blogs for all financial advisors to follow. (InvestmentNews)

Investor relations is coming into the social media age. (Finance 2.0)

Abnormal Returns is a founding member of the StockTwits Blog Network.