I was reading the latest edition of Mutual Fund Observer for July when I came across a profile of a relatively new mutual fund the Seafarer International Growth and Income Fund (SFGIX). The write-up is typically thorough. I always find it interesting when a portfolio manager with a good track record leaves their prior shop to go out on their own. It seems like all of the incentives are at least working in the right direction.

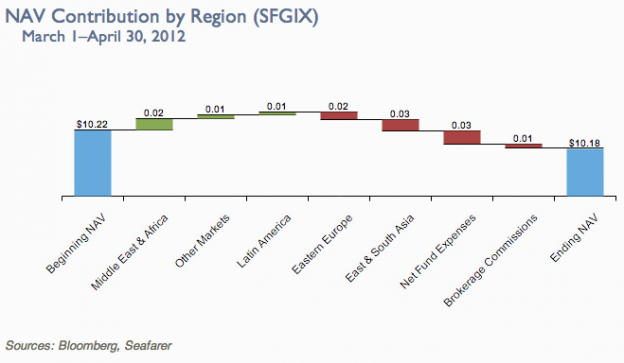

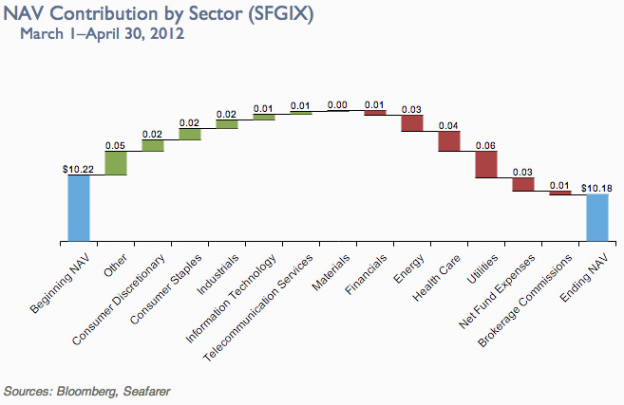

After clicking over to the Seafarer site I came across a couple of interesting performance graphs. I should probably leave this to Tom Brakke at the research puzzle but I found the performance presentation illuminating for two reasons. This had to do with the quality of the below graphs that clearly show the role commissions and expenses play in performance. This stands in marked contrast with most investment firms whose web-based communications are acceptable at best. Below you can see the NAV contribution of the fund by region, the second by sector. These graphs do a nice job of helping describe the fund’s strategy and performance.

and

None of this should be considered an endorsement of this relatively new fund. However it is nice to see that they have put some thought into their performance presentation. Because most investors, myself included, will make their way to the performance page before examining the fund’s strategy and management in greater detail. In short, it pays to put your best foot forward especially for a new mutual fund firm.