Quote of the day

Conor Sen, “The [hedge fund] superstars of the next 10 years, in addition to excelling at investment management, will have to come up with an entirely new firm structure that can get past the short-termism of the present.” (Minyanville)

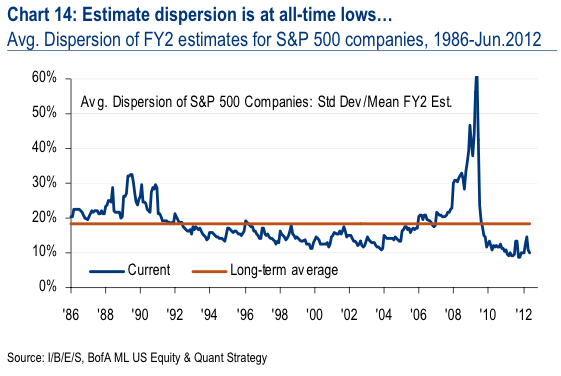

Chart of the day

Wall Street analysts are herding in a big way. (Money Game)

Video of the day

David Rosenberg talks with Consuelo Mack. (Wealthtrack)

Markets

Are analysts wrong about 2013 earnings? (Crossing Wall Street)

Are big investors getting a sneak peak at sell-side analyst research? (NYTimes also Daily Intel, Leigh Drogen)

Are ETFs still the bargain they used to be? (Vanguard)

Why are muni bond investors so complacent? (Sober Look)

The US Treasury is getting a pass, for now. (Bloomberg)

Strategy

The real trader test: content matters. (Brian Lund)

Politics and investing don’t mix. (Big Picture)

How to evaluate the performance of currency managers. (Institutional Investor)

Thinking about diversification and risk reduction in different way. (CSS Analytics)

Decision making

Why a focus on failure will help in decision making. (The Psy-Fi Blog)

Unexpected events, good or bad, make us less likely to take risks. (LiveScience via Freakonomics)

Frank Partnoy, “Speed is killing our decisions…If every one else moves too quickly, we can win by going slow.” (HBR)

Technology

Why Apple ($AAPL) may make a smaller form iPad. (NYTimes)

Samsung and Apple dominate the value chain in the mobile phone industry. (Asymco)

Microsoft ($MSFT) is getting anxious about the inroads Google ($GOOG) Apps are making. (WSJ)

When users create all the value, free is still the right business model. (A VC)

Why Digg failed. (Digits)

Companies

“No companies” are off limits from activist investors these days. (WSJ also Bloomberg)

No wonder companies are getting out of the defined benefit business. (Sober Look)

Can anything stop Amazon ($AMZN) from taking over retailing? (Time)

Finance

Now every futures brokerage is suspect in the eyes of customers. (WSJ)

More questions about how JP Morgan ($JPM) got into such a mess. (Bloomberg, Dealbook)

London is a big loser in the Libor mess. (Bloomberg)

Did Morgan Stanley ($MS) lose Mark Zuckerberg as a client? (Felix Salmon)

China

China is in a soft landing, for now. (Gavyn Davies)

Wage growth is accelerating in China. (WSJ)

Economy

A big drop in retail sales in June. (Calculated Risk, Money Game)

However the Empire State Index shows expansion. (Bloomberg)

Why talk of a recession is premature. (Pragmatic Capitalism)

A historical look at US oil production. (Gregor Macdonald)

Does a bloated Wall Street hurt economic growth? (Planet Money)

Earlier on Abnormal Returns

What you missed in our Monday morning linkfest. (Abnormal Returns)

Bear markets

A bear market in Maine lobster prices. (WSJ)

How to support your company’s “internal entrepreneurs.” (HBR)

RIP, Barton Biggs. (Bloomberg, Businessweek, MarketBeat, TheStreet)

Abnormal Returns is a founding member of the StockTwits Blog Network.