Quote of the day

Carl Richards, “If you’re going to get out of the market, make it a permanent decision, please.” (Globe and Mail)

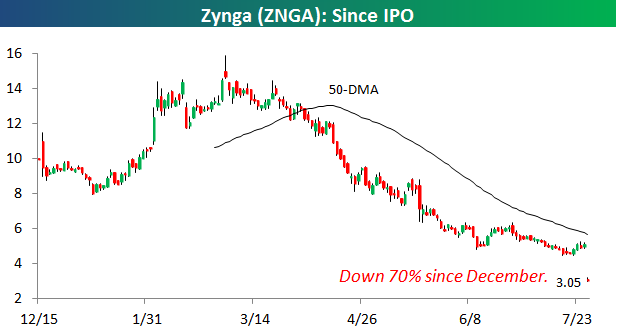

Chart of the day

Zynga ($ZNGA) is a prime example why many investors have lost faith in the markets. (Bespoke also The Real Fly)

Markets

European weakness is now weighing heavily on earnings. (WSJ also Pragmatic Capitalism)

Money market mutual funds continue to flee Europe. (FT Alphaville)

Investors are still sticking with muni bonds. (Businessweek)

Strategy

Call it whatever you want but you are likely engaged in market timing. (Rick Ferri)

Why the IPO game is stacked against investors. (The Reformed Broker)

Companies

An astounding stat about Las Vegas Sands ($LVS) results. (Kid Dynamite)

Commodity prices matter: the case of Buffalo Wild Wings ($BWLD). (research puzzle pix)

Three high flying momentum stocks that haven’t cracked…yet. (YCharts Blog)

Why Howard sold his Twitter stock: because he could put the money to work elsewhere. (Howard Lindzon)

Technology

Jumping ship on Microsoft’s ($MSFT) stock and its vision of computing. (Bronte Capital)

The questions Facebook ($FB) needs to answer in its conference call. (Time, Pando Daily)

Why Netflix ($NFLX) is ultimately doomed. (Slate)

Why Apple ($AAPL) is still in the catbird seat. (Forbes, YCharts Blog)

Why Amazon ($AMZN) may be worth its high price: changed habits. (Vitaliy Katsenelson)

Finance

Private BDCs do far more for broker than ever will for their clients. (Wealth Management)

Barton Biggs on when Wall Street went off its moorings. (Credit Writedowns)

What is Morgan Stanley ($MS) worth broken up? (Bloomberg)

Companies are choosing to file confidential IPO documents. (peHUB)

ESMA is going to ensure investors receive securities lending revenue. (FT)

Venture capital

Who is right on Internet valuations: VCs or the public? (GigaOM)

Crowdfunding platforms are gearing up for a new era. (TechCrunch)

On the importance of discipline and diversification in venture. (A VC)

ETFs

Just because something is an indexed ETF doesn’t mean it has low trading costs. (IndexUniverse)

A look at the longest duration Treasury ETFs. (IndexUniverse)

Global

European stocks are cheap: the question is when to buy. (Total Return)

Another indicator, coal prices, point to continued Chinese economic weakness. (Sober Look)

Economy

A mixed bag of economic statistics this morning. (Calculated Risk, Capital Spectator)

What are these “other tools” everyone is saying the Fed could use to jump start policy? (Bond Girl also FT Alphaville)

Do two recessions equal one depression? (MarketBeat)

June truck traffic jumped. (Calculated Risk)

Why times are so tough for today’s youth, job-wise. (Real Time Economics)

How much is the skills gap holding back economic growth? (WSJ contra The Atlantic)

Earlier on Abnormal Returns

MS, “Abnormal Returns covers a remarkable amount of ground in just under 200 pages, yet achieves its brevity without being overly shallow or simplistic.” (Mortality Sucks)

What you missed in our Thursday morning linkfest. (Abnormal Returns)

Mixed media

Has competition among scientists gotten out of hand? (Scientific American)

News you can use: predicting when you are about to get sick. (New Scientist)

Pop music has become louder and more homogenized. (Reuters via @felixsalmon)

Abnormal Returns is a founding member of the StockTwits Blog Network.