Quote of the day

Jared Woodard, ” If financial instruments like stocks and options are analogous to phrases in a language, volatility analysis is the thought process that allows you to say interesting things.” (Condor Options)

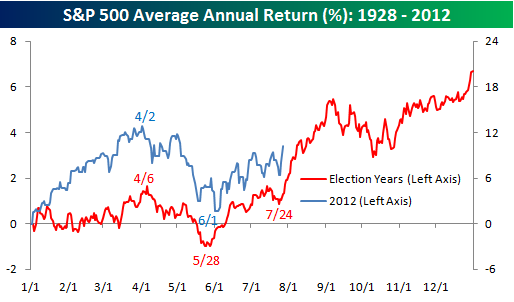

Chart of the day

2012 is playing out like most election years. (Bespoke)

Video of the day

Francois Trehan takes an optimistic tone with Consuelo Mack. (Wealthtrack)

Markets

Risky assets are once again trading together. (Sober Look)

You want a leveraged play on the global economy? Check out the coal stocks. (UpsideTrader)

The case for low bond returns going forward. (Vanguard)

Why one value manager is holding a big slug of cash. (The Reformed Broker)

Strategy

We need a better benchmark for asset allocation. (Capital Spectator)

Roger Nusbaum, “Investing can be as simple or as complicated as anyone wants to make it.” (Random Roger)

Bruce Bower, “Ultimately, you need something that works and works for you. Otherwise, you won’t believe in it.” (SMB Training)

Technology cycle

How technology valuations got turned upside down. (Felix Salmon)

Is technology destined to go through boom and bust cycles? (37signals)

Research

Both absolute and relative momentum matter. (Turnkey Analyst)

A look at the various strands of growth investing. (SSRN)

Companies

Yahoo! ($YHOO) is getting Googlfied by CEO Marissa Mayer. (AllThingsD)

Apple ($AAPL) is struggling in some emerging markets. (FT contra Economist)

Molson Coors ($TAP) trades at a big discount to market leader Anheuser-Busch InBev ($BUD). (YCharts Blog)

Finance

Francine McKenna, “The global audit market is in many ways similar to that of the credit rating agencies. It is an oligopoly sponsored by government mandates.” (FT)

When did the world’s stock markets forget their original purpose? (Economist)

Funds

Burton Malkiel on the future of ETFs. (IndexUniverse)

There are plenty of questions still to answer about the future of Pimco. (Felix Salmon)

Global

As China goes, so goes the commodities “supercycle.” (Economist)

Iron ore prices continue to trend lower. (FT Alphaville)

Europe still doesn’t get it. (Tim Duy)

The SNB is having to work hard to keep the value of the Swiss franc down. (FT Alphaville)

Economy

A look at the GDP-based Recession Indicator Index. (Econbrowser)

Millenials are giving up on car ownership. (Crain’s Chicago)

Earlier on Abnormal Returns

What you missed in our Monday morning linkfest. (Abnormal Returns)

Mixed media

A Richard Thaler inspired behavioral economics reading list. (Crosshairs Trader)

How our bodies influence our preferences. (Scientific American)

Abnormal Returns is a founding member of the StockTwits Blog Network.