Quote of the day

Steven M. Davidoff, “But the bottom line is that more needs to be done to educate and help individual investors. It should become common knowledge that investing in an individual stock and trading may be fun, but it may also be dangerous to their wealth.” (Dealbook)

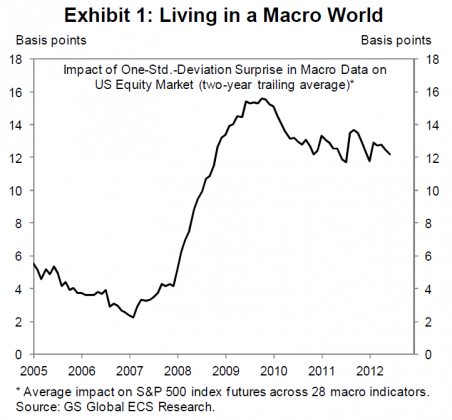

Chart of the day

Evidence showing we are living in a ‘macro world.’ (Pragmatic Capitalism)

Markets

The most bullish thing for the stock market: bearish sentiment. (Big Picture)

Some of Europe’s best companies are selling at a big discount. (Marketwatch)

Global capital markets looked past weak economies in July. (Capital Spectator)

Flash crashes only serve to reduce investor confidence in equities. (Doug Kass)

Institutional investing

Are investment benchmarks relevant for investors with long-term time horizons? (Avenue of Giants)

Institutional investors want alternative asset classes. (All About Alpha)

Signs of life amidst long-short hedge funds. (FT)

Strategy

Where one TAA model stands going into August. (MarketSci Blog)

Don’t trade if you don’t want to. (Brian Lund)

Lessons from the Facebook ($FB) IPO fiasco. (Tyler’s Trading)

Bill Gross

Bill Gross, don’t forget about dividends! (Henry Blodget)

Does it matter how much Bill Gross makes? (Learn Bonds)

Should we care what Bill Gross has to say about equities? (Term Sheet, Value Plays)

Finance

Noted macro hedge fund manager Louis M. Bacon is returning some investor funds. (Dealbook)

Why you can’t really trust auditors. (Mortality Sucks)

How negative interest rates presage the death of banking. (FT Alphaville)

Should we be concerned forex volume is slowing. (WSJ)

Libor is the new asbestos. (Businessweek)

ETFs

Some ETF launches worth keeping an eye on. (IndexUniverse)

End users really don’t want a physically-backed copper ETF to launch. (Institutional Investor)

Global

The Euro economies are weak, weak, weak. (beyondbrics, Free exchange)

The yuan is no longer overvalued. (Calafia Beach Pundit)

Why India suffered the world’s biggest blackout. (Scientific American)

Economy

The July ADP employment report shows growing payrolls. (Calculated Risk, Global Economic Intersection)

The ISM manufacturing report for July sits right around 50. (Crossing Wall Street, Calculated Risk)

Where housing stands: supply vs. demand. (Sober Look)

A look at the decline of coal use in the US. (Wonkblog)

Crop insurance is nearly ubiquitous for corn and soybean farmers. (WSJ)

Earlier on Abnormal Returns

What you missed in our Wednesday morning linkfest. (Abnormal Returns)

Social finance

Is “social trading” the savior of online brokers? (Huffington Post)

How StockTwits established the $TICKER as the de facto standard for social finance. (Content Matters also Rant Finance)

Social media

Social media as an online focus group. (NYTimes)

Twitter is building a platform built on ‘cards.’ (AllThingsD)

Personal technology

Hotmail is now Outlook.com and it compares favorably to Gmail. (Slate)

Comparing the big online storage players. (WSJ)

The big online players would prefer it if RSS just went away. (SMH)

Mixed media

People in the media have a funny definition of failure. (Daniel Gross)

Ten reasons why winners keep winning. (HBR)

Abnormal Returns is a founding member of the StockTwits Blog Network.