Quote of the day

Robert H. Frank, “The upshot is that the fate of products in general — but especially of those in the intermediate-quality range — often entails an enormous element of luck.” (NYTimes)

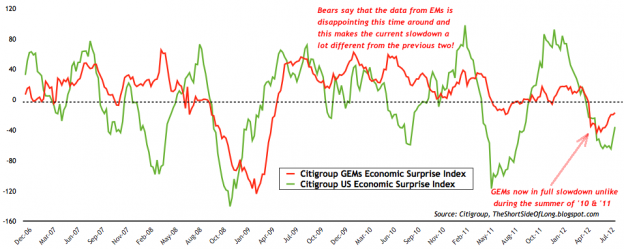

Chart of the day

How this year’s slowdown is different than last year’s: emerging economies are weaker. (Long Side of Short)

Markets

DH, “The public is scared and the world hasn’t folded in on itself despite what feels like hundreds of close calls.” (Dynamic Hedge)

Defensive sectors continue to lead the market higher. (StockCharts Blog)

Market breadth is lagging the rally. (Bespoke)

Keep an eye on the surging Aussie dollar. (Market Anthropology)

Strategy

Alternatives for investors really fed up with stocks. (NYTimes also A VC)

How the JOBS Act is going to make life difficult for investors. (Jason Zweig)

Why Bill Gross is wrong about equity returns. (Henry Blodget)

Research

Do individual investors learn from their mistakes? (SSRN via @quantivity)

How tax efficient are investment styles, like value, momentum and growth? (SSRN)

Knight Capital

Where was Knight Capital’s ($KCG) kill switch? (Dealbook, WSJ, Businessweek)

Just how colossally did Knight screw up and what did it cost to unwind its mistakes? (Kid Dynamite, CNBC)

What out of control markets look like. (research puzzle pix)

Why more Knights are likely to happen. (Term Sheet)

Finance

The US Treasury is looking to unload more AIG ($AIG) shares. (Bloomberg)

The repeal of Glass-Steagall didn’t cause the financial crisis, but it sure didn’t help either. (WashingstonPost)

Warren Buffett is backing away from munis. (WSJ)

Think trading bonds in the US is tough? Just go to Europe. (NYTimes)

Hedge funds

Small hedge funds once again outshine their bigger brethren. (Reuters)

How hedge funds are like rock festivals. (Breakingviews)

ETFs

Fidelity is sniffing around the active ETF space. (Businessweek)

Preferred stock ETF buyers should figure out what they own. (Barron’s)

Global

European companies are taking advantage of low rates. (Economist)

Germany’s manufacturing sector has joined the rest of Europe in retreat. (Sober Look)

Economy

More reactions to the “good enough” jobs report. (Capital Spectator, Real Time Economics, Econbrowser)

Five myths about the middle class. (WashingtonPost)

Earlier on Abnormal Returns

What you missed in our Saturday morning long form linkfest. (Abnormal Returns)

Top clicks this week on Abnormal Returns. (Abnormal Returns)

Tech

How IPOs serve as a distraction to building actual businesses. (Dealbook)

For some tech startups 10 million is the new 1 million. (Chris Dixon)

Social media aggregation wasn’t a thing a month ago, now there are four companies in the space. (Pando Daily)

Young people never even sign up for cable. (Atlantic Wire)

Mixed media

USA Track is looking to turn itself around. (WSJ)

Sometimes training too hard is worse than not training enough. (NYTimes)

Abnormal Returns is a founding member of the StockTwits Blog Network.