Quote of the day

Howard Lindzon, “Today, active is dirty and passive is holy. I say always be active when it comes to your money. The more active the better. Open your statements, sell your losers, think about investments and trends with momentum and be scrappy about your money.” (Howard Lindzon)

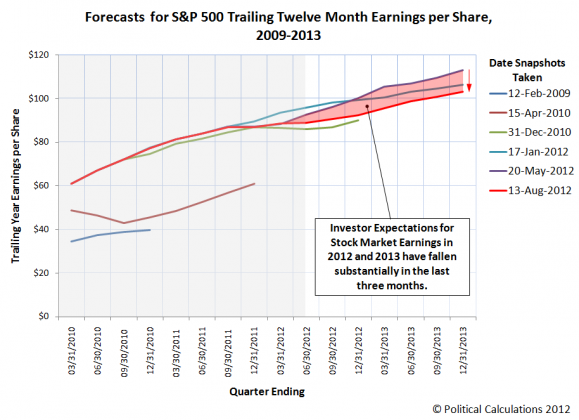

Chart of the day

Check out the drop in S&P 500 earnings expectations for 2012-13 over the Summer. (Political Calculations)

Video of the day

Charlie Ellis and Mark Cortazzo talk investment fees with Consuelo Mack. (Wealthtrack)

Markets

Checking in on the, unanimously positive, major asset classes. (Capital Spectator)

How options markets have changed since 2008. (Condor Options)

Why global macro hedge funds are underpeforming. (Behavioral Macro)

Hedge funds are getting more neutral on Euro stocks. (Bloomberg)

Bonds

Every muni bond issuer is different. (Total Return also Money Game)

Heads Warren Buffett wins, tails he wins as well. (Learn Bonds)

Newly issued low coupon investment grade debt are likely to lose investors money after inflation. (WSJ)

Strategy

There is a difference between having fun and making money. (Brian Lund)

How taxes affect your asset allocation. (Morningstar)

Lessons from the 20 years of Smart Money magazine. (SmartMoney)

Who’s on your ‘Investing Mount Rushmore‘? (The Reformed Broker)

Research

How to build a better Dow. (SSRN)

Has insider trading become more rampant in the US? The evidence says yea. (SSRN via @jasonzweigwsj)

On our inconsistent approach to returns and risk. (Falkenblog)

Energy

On the economics of shipping US natural gas around the globe. (WSJ)

The lifespan of a shale oil well may not be as long as previously thought. (FT Alphaville)

Companies

Which would you rather own: E*Trade ($ETFC) or Apple ($AAPL)? (YCharts Blog)

Google ($GOOG) extends its portfolio of brands with the Frommer’s travel name. (WSJ)

How the public got played in the run up in social media stocks. (Time)

A tale of two retailers. (Jeff Matthews)

The big box electronics retailer that is actually growing store count, hh Gregg ($HGG). (Time)

Finance

Robo-signing, redux: the case of credit cards. (Dealbook)

Knight Capital Group ($KCG) is back up and running. (Clusterstock)

Just how big are 401(k) loan defaults? (Felix Salmon)

Gary Gensler has reinvigorated the CFTC. (Dealbook)

ETFs

Why it is so hard to beat a total stock market index fund. (Rick Ferri)

A closer look at the SPDR SSgA Multi Asset Real Return ETF ($RLY). (TheStreet)

Global

China is trying hard to generate a stock market rally. (Sober Look)

The Swedish krona is at 12-year high against the Euro. (Institutional Investor)

Don’t forget about Portugal. (Newsweek)

Earlier on Abnormal Returns

What you missed in our Monday morning linkfest. (Abnormal Returns)

Mixed media

To get ahead you have to pay yourself first. (Rogue Traderette)

What is the most underrated innovation of the past century? (Marginal Revolution)

A happy 10th birthday to Daring Fireball. (The Atlantic via kottke)

You ever wonder where all that output from “pundits” comes from? So do they. (Daniel Drezner also Huffington Post)

Abnormal Returns is a founding member of the StockTwits Blog Network.