Quote of the day

George Soros, “Participants act not on the basis of their best interests but on their perception of their best interests, and the two are not identical.” (Ivanhoff Capital)

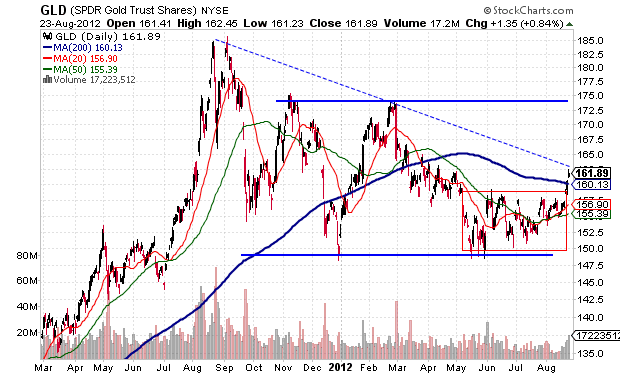

Chart of the day

Gold has broken out. (DowntownTrader)

Bonds

A look back at just how extraordinary bond returns have been. (Timely Portfolio)

Time to ratchet down your high yield muni fund risk. (Learn Bonds)

What the TIPS market is telling us of late. (Calafia Beach Pundit)

Hedge funds

Hedge funds are no panacea in a bear market. (Attain Capital)

In all seriousness why does John Paulson bother with outside capital? (Deal Journal)

A look at Brazil’s burgeoning hedge fund industry. (Institutional Investor)

Companies

Facebook ($FB) is trying to reorient itself for the mobile era. (NYTimes)

The stock market really hates Intel ($INTC) at present. (StockCharts Blog)

Finance

The NY Fed is out of the AIG ($AIG) bailout business. (WSJ, ValuePlays)

Is there a plan B on how to reform the money market mutual fund industry? (Dealbook, WSJ)

Auditors are apparently not all that good at auditing. (NYTimes)

What went wrong with unlisted REITs? (Forbes)

The Chinese Wall is pretty porous these days. (I Heart Wall Street, Marketwatch)

ETFs

Mutual funds holding ETFs: big deal or not? (Marketwatch, Capital Spectator, IndexUniverse)

Some more bear ETFs are coming that hope to avoid the issue negative compounding. (Focus on Funds)

Global

Inventory is piling up in China. (Sober Look)

A look at an unusual cross-rate: Real vs. the Pound. (WSJ)

Economy

The durable goods report was a mixed bag. (Global Economic Intersection, Capital Spectator)

Rail traffic continues to show “modest” expansion. (Pragmatic Capitalism)

A couple of interesting facts about new home sales. (Economix)

Earlier on Abnormal Returns

What you missed in our Friday morning linkfest. (Abnormal Returns)

Mixed media

Why it is important to realize that experiences are better than possessions. (Peer Reviewed via FT Alphaville)

Fast food providers are now on high alert for any charges of animal cruelty. (Money & Co.)

For any business it’s more important to be kind than clever. (HBR)

Abnormal Returns is a founding member of the StockTwits Blog Network.