Quote of the day

Adam Grimes, “Most things that people say work in the market do not actually work. Treat claims of success and performance with healthy skepticism. I can tell you, based on my experience of nearly twenty years as a trader, most people who say they are making substantial profits are not. This is a very hard business.” (Notes on the Market)

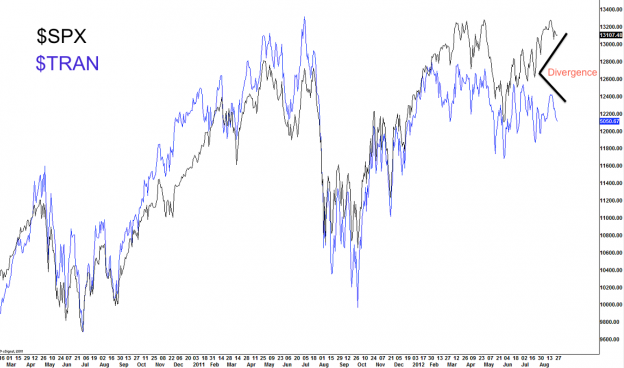

Chart of the day

Transports have been selling off. (Dynamic Hedge)

Markets

Market breadth remains weak. (Bespoke)

The markets are waiting for four things to be resolved. (The Reformed Broker)

Strategy

Michael Stokes, “The only thing that really matters in judging a strategy is actual, real-time, verifiable trading results. Everything else is window dressing.” (MarketSci Blog)

Why are you trading this week? (Points and Figures)

Three mistakes investors make when working with an investment adviser. (Forbes)

Companies

How much is the iPhone franchise worth? (Musings on Markets)

Apple’s ($AAPL) next act will be built on another interface. (Pando Daily)

Facebook ($FB) didn’t have to go public. (Fortune)

Warren Buffett

Warren Buffett’s bet on Wells Fargo ($WFC) is paying off this year. (Bloomberg)

Why Warren Buffett stayed in Omaha. (AP via Dealbreaker)

Finance

Hedge fund advertising should be, if nothing else, entertaining. (Dealbreaker, WSJ)

What are the social costs of high frequency trading? (Marginal Revolution)

Money market mutual funds continue to flee Europe. (FT Alphaville, Sober Look)

ETFs

Junk bond ETFs are driving high yield bond volumes. (Focus on Funds)

Everybody is coming to market with actively managed ultra short-term bond ETFs. (IndexUniverse)

Economy

The four things Ben Bernanke could announce at Jackson Hole. (Gavyn Davies also Money Game)

Manufacturing activity is definitely slowing. (Bonddad Blog)

How July stacked up when it comes to economic indicators. (Capital Spectator)

Weekly initial unemployment claims are creeping up. (Calculated Risk)

Trucking volumes continue to move sideways. (Calculated Risk)

Earlier on Abnormal Returns

If you want to see what it means to be devoted to a craft check out Jiro Dreams of Sushi. (Abnormal Returns)

What you missed in our Thursday morning linkfest. (Abnormal Returns)

Wind

High tech kites may be the future of wind power. (WSJ)

A great visualization of the wind. (wind map via Graphic detail)

Abnormal Returns is a founding member of the StockTwits Blog Network.