Quote of the day

John Kay, “Statistics are only as valid as the sources from which they are drawn and the abilities of those who use them. When I discover something surprising in data, the most common explanation is that I made a mistake.” (John Kay)

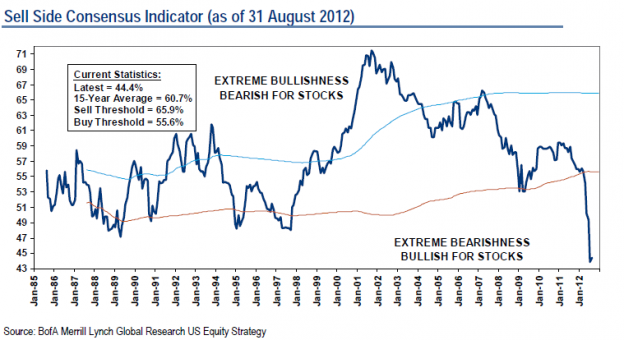

Chart of the day

Sell-side strategists still hate stocks. (Big Picture)

Markets

You can’t analyze the ‘Sell in May‘ phenomenon without September. (Mark Hulbert)

News doesn’t drive markets: investors do. (Big Picture)

Fund managers think about risk differently than you. (Above the Market)

How much bad timing has cost equity fund holders of late. (The Reformed Broker)

Strategy

Who is to blame for your Facebook ($FB) losses. Easy, you are. (Bloomberg)

The four crucial beliefs of successful investors. (StockCharts Blog)

How do you know if you are not cut out for trading. (Rogue Traderette)

Does the quant blogosphere herd? (MarketSci Blog)

Retirement

Optimized social security benefits and the idea of “household alpha.” (Enterprising Investor)

70 is the new 65. (Rick Ferri)

Companies

Quirky raises big bucks and looks to expand crowdsourced product design. (WSJ, Pando Daily)

Yahoo! ($YHOO) is making a big bet by holding onto its ad tech business. (SAI)

Another reminder than mining stocks are not the same thing as the metals. (Investment News earlier Abnormal Returns)

Finance

HFT is going nowhere because that is what the exchanges want. (Points and Figures)

In the eyes of many pension funds the big buyout funds are just not getting it done. (WSJ)

Things are so bad investment banks are having to focus on their “core strengths.” (FT)

Bond investor conference calls are the new earnings calls. (WSJ)

Funds

What lessons can we learn from recent ETF closures? (IndexUniverse)

Investors keep pouring money into bank loan funds. (MarketBeat)

The iShares High Dividend Equity Fund ($HDV) is gathering assets at a torrid pace. (IndexUniverse)

Employment

Yet another exceedingly mediocre jobs report despite the drop in the unemployment rate. (Calculated Risk, Daniel Gross, RTE, Capital Spectator, Bonddad Blog, Felix Salmon)

The odds of further QE just went up. (Real Time Economics)

Men continue to flee the labor force. (Economix)

Economy

Keep in mind some caveats to the shale gas boom. (WSJ)

Invictus, “There are some things private industry cannot do that only government can do.” (Big Picture)

Why China may start selling Treasuries and why it doesn’t matter. (FT Alphaville)

Earlier on Abnormal Returns

What you missed in our Friday morning linkfest. (Abnormal Returns)

Apple

Blogging about Apple is big business. (Bloomberg via Talking Biz News)

Instead of taking on Pandora ($P), Apple ($AAPL) should fix iTunes. (SiliconBeat)

Meet Apple’s favorite blogger: John Gruber. (Businessweek)

Psychology

Jordan Weissman, “Being busy is a nice problem to afford.” (The Atlantic)

A gambling addiction isn’t about winning and losing it’s about how long you play the game. (MIT news)

Abnormal Returns is a founding member of the StockTwits Blog Network.