Quote of the day

Jeff Miller, “The bogus fundamentals of the “headwinds pundits” never change. They can always complain that there is too much debt and too much government.” (A Dash of Insight)

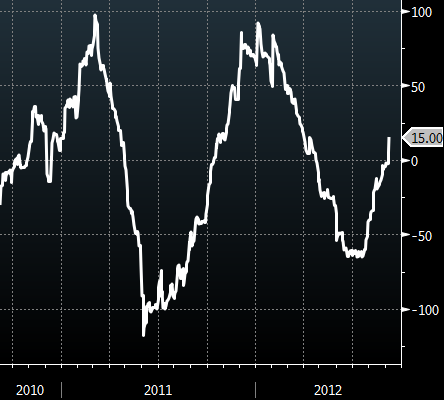

Chart of the day

The Citigroup Economic Surprise Index has turned positive. (Sober Look)

Markets

Four out of five fundamental market indicators are moving in the right direction. (Dynamic Hedge)

Junk bond yields hit an all-time low. (WSJ)

Five years of commodities. (research puzzle pix)

How really long dated, or “super options” would change the options market. (Barron’s)

Strategy

Fifteen investment lessons learned from fantasy football. (Minyanville)

We finally found some one to blame for the Facebook ($FB) debacle. (The Reformed Broker)

Companies

Are American CEOs really not that overpaid? Research says no. (Economist)

Are daily deals anything more than a fad? (Pando Daily)

Do sport and stock markets even mix? (Economist)

Nokia ($NOK) now “looks deader than before.” (Farhad Manjoo)

Finance

Greater access to private offerings offer more risk than reward for retail investors. (Jason Zweig)

Arnuk and Saluzzi take on high frequency trading. (NYTimes also MacroBusiness)

Funds

Don’t expect money market mutual fund reform any time soon and that should be a scandal. (NYTimes, Free exchange)

A useful exercise in fund math at the Sprott Physical Gold Trust ($PHYS). (Kid Dynamite)

Economy

QE is coming. (Calculated Risk also NetNet)

More on the tepid NFP number. (Econbrowser, FT Alphaville, Economix, The Atlantic)

Inflation expectations are on the rise. (Sober Look)

Earlier on Abnormal Returns

What you missed in our Saturday long form linkfest. (Abnormal Returns)

What links everyone else were clicking on this week. (Abnormal Returns)

Mixed media

A review of Jason Kelly’s The New Tycoons: Inside the Trillion Dollar Private Equity Industry That Owns Everything. (Aleph Blog)

A review of the new Richard Gere hedge fund movie Arbitrage. (Barron’s)

The 25 best episodes of Seinfeld. (Paste Magazine)

Abnormal Returns is a founding member of the StockTwits Blog Network.