This is an early and incomplete edition of the linkfest. We will catch up with you tomorrow.

Quote of the day

Brenda Jubin, “Traders often repeat the same mistakes over and over, acting on triggers that have served them poorly time and time again even as they continue to expect a tidy profit as a reward.” (Reading the Markets)

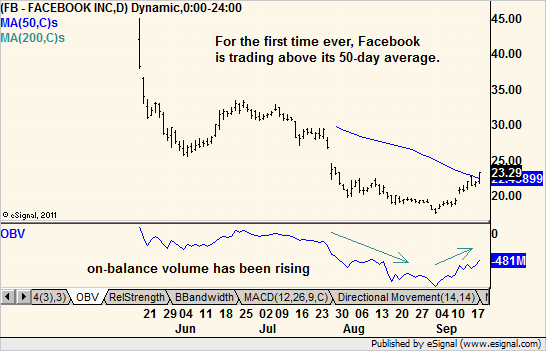

Chart of the day

You have to start somewhere. Facebook ($FB) is above its 50 day moving average for the first time. (Minyanville)

Markets

Taking pause at the accumulating warnings from transport companies. (Horan Capital)

Checking in on Eddy’s gold model. (Crossing Wall Street)

Strategy

Jim Chanos on the downside of using 13-F filings from hedge funds. (Clusterstock)

An interesting discussion with Michael Mauboussin on how to improve your investment decision making. (Motley Fool)

Companies

Is CVS ($CVS) that much better a company than Walgreen’s ($WAG) to deserve a premium valuation? (SumZero)

Avocados are hot. Just check out the performance of Calavo Growers ($CVGW). (YCharts Blog)

Yet another example of smart investing at Leucadia National ($LUK). (The Brooklyn Investor)

Technology

3 out of 4 venture-backed startups go bust. (WSJ)

How the venture capital industry is changing over time. (peHUB)

More companies are relying on algorithms for hiring decisions. (WSJ)

Finance

Visualizing the decline in the money market mutual fund industry. (research puzzle pix)

Occupy Wall Street should read John Bogle’s new book The Clash of Cultures: Investment vs. Speculation. (Rick Ferri)

Economy

Weekly initial unemployment claims continue to trend up. (Calculated Risk)

Gavyn Davies’ favorite macro blogs. (FT)

Good luck trying to measure aggregate happiness. (FT Alphaville)

Earlier on Abnormal Returns

What you missed in our Thursday morning linkfest. (Abnormal Returns)

Mixed media

Coursera continues to add university partners. (NYTimes)

Cool stuff happening online. (World Beta)

Reviews of iOS 6 roll in. (Apple 2.0)

Abnormal Returns is a founding member of the StockTwits Blog Network.