Quote of the day

Joe Weisenthal, “Earnings are at new highs, and the data is doing the opposite of deteriorating. To say that the market is somehow squeezed between the Fed and reality is preposterous. Both are favorable right now.” (Money Game)

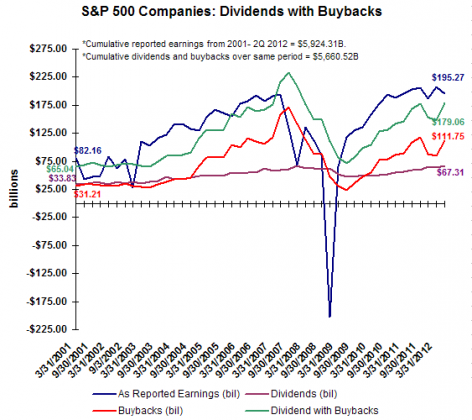

Chart of the day

S&P 500 dividends plus buybacks are nearing 2007 levels. (HORAN Capital Advisors)

Markets

Signs of excessive bullishness are piling up. (Capital Observer, Pragmatic Capitalism)

Transports got thrashed this week. (MarketBeat, Bespoke)

Why you should expect to see a surge in special dividends in Q4. (Income Investing)

Even after it’s big fall, Facebook ($FB) stock is still overvalued. (Barron’s)

Strategy

Too high aspirations as a form of leverage. (Jason Zweig)

Charts don’t lie, people often do. (All Star Charts)

Four keys to long term successful investing. (StreetTalk Live)

Apple

Joe Nocera asks whether Apple ($AAPL) has peaked. (NYTimes)

The only iPhone 5 feature that matters: LTE. (ReadWriteWeb)

Apple should have weaned itself from Google Maps a long time ago. (Apple 2.0 also Pando Daily)

David Pogue and John Gruber talk about iPhone 5 launch. (Charlie Rose)

Finance

Wall Street is about selling stories, even if they don’t make sense. (The Reformed Broker)

Morgan Stanley ($MS) is sick of Citigroup ($C) hanging around the MSSB offices. (Dealbreaker)

The days of megabuyouts are gone. (Deal Journal)

ETFs

The ETF price wars are raging: who wins? (The Reformed Broker)

What do low ETF fees mean for investors? (Ari Weinberg)

Are passively managed high yield ETFs a bad idea? (Focus on Funds)

Economy

The spread between the yield on mortgage backed securities and actual mortgages continues to grow. (Sober Look)

The ECRI WLI is at its highest level in over a year. (dshort)

States haven’t made much headway in cutting the pension funding shortfalls. (WSJ)

Earlier on Abnormal Returns

What you missed in our Saturday long form linkfest. (Abnormal Returns)

What everyone else was clicking on this week on Abnormal Returns. (Abnormal Returns)

Mixed media

Olive oil prices have surged 50% in the past three months. (Economist)

Kickstarter is maturing. (Felix Salmon)

Sleep: you’re doing it wrong. (NYTimes))

Abnormal Returns is a founding member of the StockTwits Blog Network.