Quote of the day

Bruce Bower, “Monetary goals can actually serve as a distraction to trading well.” (SMB Training)

Chart of the day

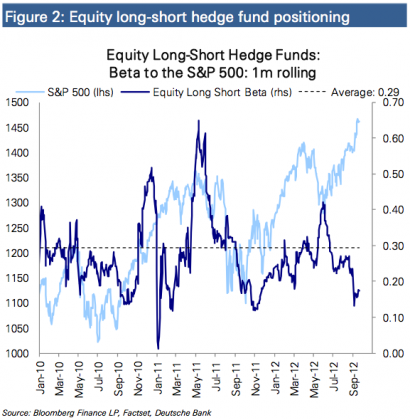

Hedge funds have not bought into this rally. (Money Game)

Markets

Fear vs. greed: greed is winning. (Alhambra Partners via TRB)

Uh oh. Companies are beginning to cut dividends. (Political Calculations)

Bonds

Retail investors are jumping into syndicated loan funds. (Sober Look)

Are ETFs driving corporate bond returns? (Zero Hedge)

Bond funds vs. individual bonds: depends on your needs. (Rick Ferri)

Strategy

Trades in children’s accounts are “very successful at picking stocks.” (Journal of Finance)

Five signs you might not make it as a trader. (Brian Lund)

Gen Y is bit gun shy, investment-wise. (Vanguard earlier TRB)

Apple

Is 5 million iPhone 5s a lot or not? (GigaOM, AllThingsD)

Doug Kass is worried about Apple ($AAPL). (Tech Trader Daily, Money Game)

Finance

Why does a market exist? (Points and Figures)

Free checking is not all that free these days. (WSJ)

ETFs

How can ETF managers keep fees so low? (Marketwatch)

The (retiring) fund manager you likely never heard of. (Chuck Jaffe)

Global

The optionality in shorting the Japanese Yen. (In Pursuit of Value)

In the end not all that much has changed in Europe. (Sober Look)

Business expectations in Germany continue to ebb. (FT Alphaville)

Europe’s periphery is no longer running a trade deficit. (Sober Look)

Economy

The Chicago Fed National Activity Index weakened in August. (Calculated Risk, dshort)

Some concerning signs for manufacturing. (Bonddad Blog)

Will permanently higher oil prices be a cap on economic growth? (Bloomberg)

How can QE affect oil prices? (Econbrowser)

How is the US doing protecting fish stocks? (Wonkblog)

Earlier on Abnormal Returns

What you missed in our Monday morning linkfest. (Abnormal Returns)

Mixed media

Mathew Ingram, “The social web lowers the barriers to interaction.” (GigaOM)

Are liberal arts colleges failing America? (The Atlantic)

Quartz is now live. (Quartz)

Abnormal Returns is a founding member of the StockTwits Blog Network.