Quote of the day

John Burbank, “I basically would be long high quality, leading companies which generally in the United States and then short speculative companies that rise into Fed announcements but then fall away.” (Market Folly)

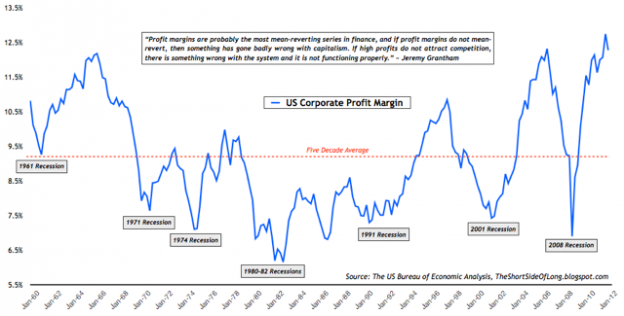

Chart of the day

Are corporate profit margins ever going to mean-revert? (The Long Side of Short)

Markets

Individual investors continue to turn away from the stock market. (WSJ)

The risk-return equations for bonds is no longer attractive. (In Pursuit of Value)

Checking in on the slope of the yield curve. (Crossing Wall Street)

The headwinds facing mortgage REITs. (Minyanville)

Will oil and natural gas ever re-converge? (Turnkey Analyst)

Companies

Predicting the price of Apple ($AAPL) using capital expenditures. (Asymco)

Ignore the 3-D printing trend at your own peril. (Howard Lindzon)

Does Zynga ($ZNGA) have a future? And what does it mean for Facebook ($FB)? (Fortune, Minyanville)

ETFs

A look at the entry of CRSP into the indexing game. (IndexUniverse, Rick Ferri)

Vanguard still tops Schwab ($SCHW) in an ‘ETF smackdown.’ (Allan Roth)

Why you may want to pass on the big emerging market ETFs. (IndexUniverse)

The October 2012 ETF Deathwatch. (Invest With an Edge)

Employment report

Positive revisions drive reactions to the September jobs numbers. (Calculated Risk, Quartz, Daniel Gross, Capital Spectator, Bonddad Blog, Econbrowser)

Car sales confirm better jobs numbers. (Money Game)

US demand for natural gas can’t keep up with supply, hence the desire for exports. (WSJ)

A look at the diverging US and European economies. (Pragmatic Capitalism)

Earlier on Abnormal Returns

What you missed in our Friday morning linkfest. (Abnormal Returns)

Mixed media

Why big data will never replace thinking. (Justin Fox)

A long Canadian nightmare is over: the missing maple syrup stash recovered. (NYDN)

How fox squirrels ‘invest’ for future consumption. (EurekaAlert via @markthoma)

Abnormal Returns is a founding member of the StockTwits Blog Network.