Quote of the day

Jack Bogle, “Get out of the casino, own Corporate America and hold it forever…No trading, no nothing. You don’t need to trade; you don’t need to worry about the market.” (The Tell)

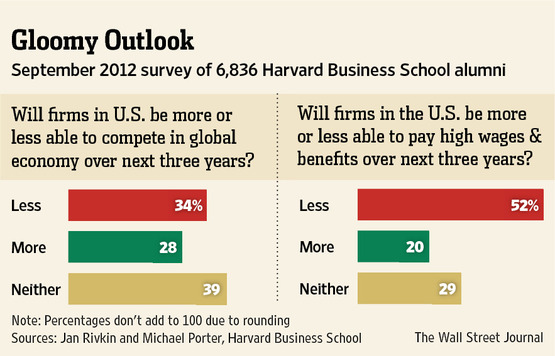

Chart of the day

Global executives are gloomy about the prospects for US business. (WSJ)

Markets

Signs that investor sentiment still sucks. (The Reformed Broker)

Real yields are at multi-decade lows. (Calafia Beach Pundit)

The stock market is overpaying for perceived safety. (Crossing Wall Street)

The hedge fund industry has never been bigger. (Reuters)

Trading

Marc Principato, “What new traders need to understand is the fear of missing out is only a fear. By itself it has no relevance to our performance. ” (SMB Training)

On the challenge of finding the sweet spot between analysis and trading. (Dynamic Hedge)

Strategy

Investors want “alternatives” but don’t know what they are. (InvestmentNews)

On the dangers of trying to match long term liabilities with total return strategies. (Aleph Blog)

Why is makes sense to combine relative strength/momentum with value strategies. (Systematic Relative Strength)

Global bond managers are embracing GDP-weighted indices. (Institutional Investor)

College savers deserve better. (Morningstar)

Companies

What does Apple ($AAPL) want with the remains of Color? (TheNextWeb)

Amazon Publishing is off to a slow start as other book retailers boycott the imprint. (WSJ)

Why PayPal is doing as well as it is. (Quartz also Covestor)

Why Clearwire ($CLWR) is falling on the news of Sprint ($S) acquiring voting control. (Kid Dynamite, Dealbook)

AOL ($AOL) is doubling down on e-mail with a new product: Alto. (CNNMoney)

Finance

The new profit normal at Goldman Sachs ($GS). (Term Sheet)

Why Citigroup ($C) should dump Salomon Brothers. (FT)

Smaller broker-dealers can’t get by on stock commissions these days. (Bloomberg)

Disruptive finance

What are “loyalty shares” and how could they encourage long-term investment? (Institutional Investor)

Where have all the activist investors gone? (Institutional Imperative)

Why isn’t private equity an even more disruptive force in the economy? (Musings on Markets)

ETFs

Leverage on leverage: presenting the ETRACS Monthly Pay 2x Leveraged Mortgage REIT ($MORL). (Money Game, Income Investing)

There is more to ETF investing than headline fees. (IndexUniverse, ETF Trends)

Economy

Eleven ugly signs in corporate America. (Money Game)

Three downsides to an increasingly positive economic growth picture. (Calculated Risk)

Three weekly indicators pointing toward an improving economy. (Bonddad Blog)

Weekly initial unemployment claims climb higher. (Calculated Risk, Capital Spectator)

Earlier on Abnormal Returns

What you missed in our Thursday morning linkfest. (Abnormal Returns)

Mixed media

A corporate board’s job is to “balancing diverse, sometimes conflicting priorities and interests.” (HBR also Felix Salmon)

If your company can’t do social media well, maybe it shouldn’t do it at all. (FT)

Why we exaggerate the amount of time we work. (Quartz)

Updating the business card to a new age. (WSJ)

Abnormal Returns is a founding member of the StockTwits Blog Network.