Quote of the day

David Schawel, “The average investor likely has no idea how mortgage REITs operate and what circumstances could cause a material fall in their share prices. As an investor who deals in the MBS markets regularly, I am downright frightened that such a product is being created at a time when so many red flags are apparent.” (Inside Investing)

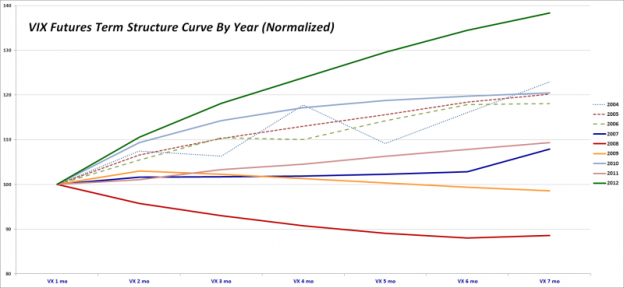

Chart of the day

Why the VIX futures term structure has been so unusual this year. (VIX and More also MarketSci Blog)

Markets

US equities are leading all other major asset classes this year. (Bloomberg)

October is filled with all sort of market outliers. (Quant Monitor)

Grain prices are staying at elevated levels. (Sober Look)

Rich guys are pulling back from the increasingly institutionalized hedge fund industry. (Reuters)

Strategy

How low-vol strategies relate to risk-of-default. (Falkenblog)

How to build global portfolios based on a CAPE model. (SSRN via World Beta)

Just how big a role does QE have on equity valuations? (Big Picture)

A look at price-to-peak operating earnings ratios and the 10-year Treasury yield. (Rick Ferri)

Multimedia

A transcript of an interview with Tim Richards author of The Zeitgeist Investor. (Motley Fool UK)

Some worthwhile perspective on the 1987 stock market crash: Consuelo Mack talks with financial historian Richard Sylla. (Wealthtrack)

Companies

If Caterpillar ($CAT) is a bellwether then the world economy is slowing. (Bloomberg)

How exactly is Facebook ($FB) going to monetize its billion user base. (WSJ)

The valuation case for GM ($GM). (SumZero)

The long term case for Coach ($COH). (YCharts Blog)

Finance

Is the strategy of buying foreclosed homes en masse already played out? (WSJ)

Why don’t the Big Four do better audits? (Grumpy Old Accountants)

CLOs are once again back in style. (FT)

Fintech

Addepar is making inroads into building the back-end for global wealth managers. (Businessweek)

Checking in on the state of StockTwits. (UT San Diego)

ETFs

An example of just how a well-designed ETF with low volume can still be efficient. (IndexUniverse)

The low cost iShares core ETFs launch. (Focus on Funds)

Just what constitutes an emerging market for core ETFs these days? (IndexUniverse)

Global

The growing economic divergence between Europe and the US. (Pragmatic Capitalism)

Tracking the growth of the emerging market middle class. (beyondbrics)

Move over BRICs here comes the S&P SMIT40 Index. (beyondbrics)

Economy

An FOMC preview. (Calculated Risk)

One of these days wage growth is going to accelerate. (Macrofugue)

What does railroad CSX ($CSX) see for the economy? (Pragmatic Capitalism)

The US should have two goals when it comes to oil. (Econbrowser)

Earlier on Abnormal Returns

What you missed in our Monday morning linkfest. (Abnormal Returns)

Sociability

How Icelanders avoid seasonal affective disorder. (The Atlantic)

Just how much do social skills affect earnings. (Wonkblog)

How to be sociable when you don’t feel like it. (Lifehacker)

Abnormal Returns is a founding member of the StockTwits Blog Network.