Quote of the day

David Merkel, “(T)he market is an ecosystem where no strategy has permanent validity. Strategies ebb and flow as many parties search for scarce returns.” (Aleph Blog)

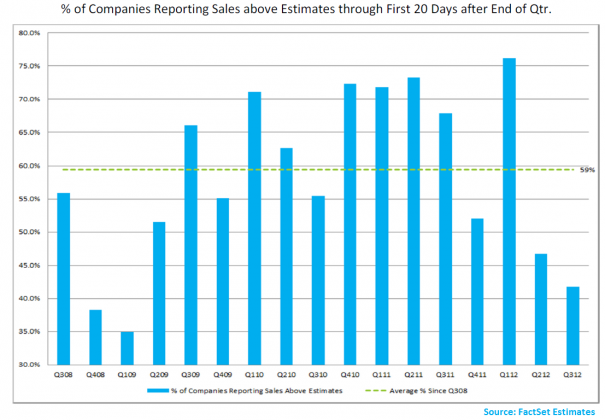

Chart of the day

Third quarter sales are disappointing to say the least. (Money Game)

Markets

The growing pressure on profit margins. (Crossing Wall Street)

Expectations for 2013 continue to wane. (BCA Research)

If political uncertainty continues to decline the stock market won’t have any more excuses. (The Exchange)

Rydex traders have stepped off the gas. (All Star Charts)

Market momentum is waning. (Market Anthropology)

Why mortgage REITs are getting squeezed. (Sober Look)

Farm land prices continue to surge. (NYTimes)

Strategy

How a really simple asset allocation wins. (Capital Spectator)

Seven ways to better focus on your trading. (Brian Lund)

Correlations

Implied stock correlations have been falling for some time now. (Sober Look)

But implied correlations just popped higher. (Money Game)

How relying on low correlations can lead your trading astray. (The Zikomo Letter)

Warning signs

Dupont ($DD) is facing weak industrial demand. (MarketBeat)

If McDonalds ($MCD) is weak, what does that say about the global economy? (YCharts Blog)

Apple

Why has Apple ($AAPL) now become so “leaky”? (ArsTechnica)

Where does Apple go from here? (MacWorld via @daringfireball)

The competition facing the forthcoming iPad Mini. (Wired)

Finance

The Funders Club is providing investor access to startups in a unique fashion. (Wired)

The UK is doing some soul searching when it comes to high frequency trading. (NYTimes, FT)

Can “forensic accounting” make for a better ETF? (IndexUniverse)

Global

Hedge funds are hot for Greek debt, but the Finns are taking a pass on southern European debt. (WSJ, ibid)

The Dutch are facing the downside of their housing bubble. (Businessweek)

Conspiracy theorists rejoice! The Bundesbank may audit its overseas gold holdings. (FT Alphaville)

Economy

Post-election we could see a 180-turn in the economic environment. (Money Game)

Ben Bernanke may leave the Fed when his term is up. (Reuters, Quartz)

Why the US may never close the output gap. (Pragmatic Capitalism)

Why aren’t higher commodity prices translating into consumer inflation? (Learn Bonds)

Is the US breaking out of its liquidity trap? (macro beat)

Earlier on Abnormal Returns

Where did all the finance bloggers go? (Abnormal Returns)

What you missed in our Tuesday morning linkfest. (Abnormal Returns)

Mixed media

Why call it an emergency fund? Call it an uncertainty fund. (Bucks Blog)

On the afterlife of your favorite TV show. (NPR)

Eww, your cellphone is covered in germs. (WSJ)

Abnormal Returns is a founding member of the StockTwits Blog Network.