Quote of the day

Richard Koo, “Once the nature of the disease and its cure are explained, Americans will feel better: they are moving in the right direction, even though the journey is a long one.” (FT)

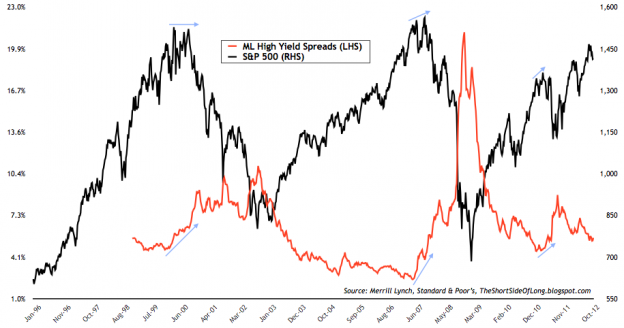

Chart of the day

Equity investors should keep an eye on high yield credit spreads. (The Short Side of Long)

Markets

The 200 day moving average is in sight. (Crossing Wall Street)

In search of a better P/E ratio. (Buttonwood)

How high can the $VIX go? (VIX and More)

Equity market returns, good and bad, are lumpy. (Random Roger)

Strategy

Cash isn’t trash in the hands of the right manager. (Inside Investing)

An equity-focused way of capturing the Halloween effect. (allETF)

Seriously, do you really know how well your portfolio is doing? (Business Logic via @ariweinberg)

Don’t do something to your portfolio in November you might regret. (The Slant)

Hope can kill your portfolio. (Old School Value)

Companies

Amazon ($AMZN) as book publisher is getting “blowback” from other book sellers. (NYTimes)

Warren Buffett is sitting on an even bigger pile of cash these days. (Bloomberg)

Android share growth is slowing. (Asymco)

Do homebuilders have more to run? (Humble Student of the Markets)

Mining companies are cutting back on capital expenditures. (FT)

Finance

Demand for credit is on the rise. (Quartz)

S&P found guilty of misleading investors in Australia. (FT Alphaville)

Consolidation continues apace in investment banking. (Dealbook, Deal Journal)

Why are so-called ‘hidden orders‘ even legal? (SMB Training)

Times are getting tougher for small hedge funds. (FT)

Global

Russian stocks are cheap. (iShares Blog, World Beta)

Big changes in monetary policy are afoot in Japan. (Money Game)

Mega bear markets: Chinese edition. (Also Sprach Analyst)

Economy

The ISM services index for October came in a little light. (Calculated Risk, Bespoke)

A look at the US manufacturing slowdown. (Bonddad Blog)

On the sorry state of financial illiteracy in America. (Rick Ferri)

Earlier on Abnormal Returns

Top clicks this past week on Abnormal Returns. (Abnormal Returns)

What you missed in our Monday morning linkfest. (Abnormal Returns)

Skill and luck

A rave review for Michael Mauboussin’s The Success Equation: Untangling Skill and Luck in Business, Sports and Investing. (Forbes)

Michael Mauboussin on investing results and the paradox of skill. (WSJ)

Voting

The changing technology of how we vote. (Forbes)

On the rationality (or not) of voting. (Stumbling and Mumbling)

People vote for all kinds of different reasons. (Rajiv Sethi)

Why voting is a general virtue. (Interfluidity)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.