The Abnormal Returns holiday book giveaway, 2012 edition, is now live. Check out the details. Don’t miss out!

Quote of the day

Tom Brakke, “The new mosaic is that which an investor or firm can create through the use of different sources, ideas, inputs, and people that can breathe life into the process of equity analysis.” (the research puzzle)

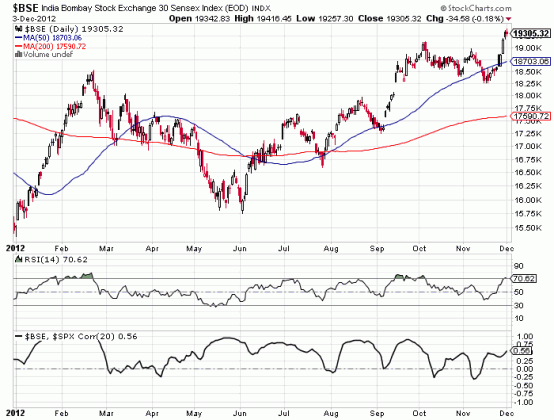

Chart of the day

Investors have bid up Indian stocks to 15.8x 2012 estimated earnings. (beyondbrics)

Markets

All eyes are on the $10 level for Bank of America ($BAC). (Phil Pearlman)

Why leveraged loans are likely to outperform high yield next year. (Economic Musings)

How top heavy is the S&P 500? (Bespoke)

The argument that the dividend cliff is no big deal. (Money Game)

More news on the special dividend front. (Crossing Wall Street)

Top ten buys and sells from the ultimate stock pickers. (Morningstar)

The bullish case for gold. (Sober Look)

Strategy

Our approach to risk is not consistent across domains. (MIT News via @MarkThoma)

Wall Street strategists are still underweighting equities. (Unexpected Returns)

Are you asking the right trading questions? (Brian Lund)

A ‘trend factor‘ is another way of measuring momentum across stocks. (SSRN)

Companies

Many US-based companies have a big slug of their cash stuck overseas. (WSJ)

Toll Brothers ($TOL) is racking up gains in sales. (The Daily Beast)

iTunes is now pretty much everywhere. (paidContent, Quartz)

Exchanges

A study of E-mini S&P 500 futures contracts shows the many ways in which HFT make money. (MarketBeat, NYTimes, Dealbreaker)

How does “dark trading” on public changes change investor behavior? (SSRN)

The NYSE is taking it to the Nasdaq. (Businessweek)

Traders love trading VIX futures. (MarketBeat)

Hedge funds

Warren Buffett thinks there are too many hedge funds these days. (Dealbook)

David Einhorn is getting longer equities. (II Alpha)

The Nobel Foundation is getting into hedge funds. (Quartz)

Finance

Banks are once again focusing on money management. (Bloomberg)

Why aren’t banks issuing more long-term debt? (Term Sheet)

Is spying on corporate jets insider trading? (NetNet)

Funds

Doubleline Capital is getting into the bank loan game. (InvestmentNews)

The problem with bond funds. (BondSquawk)

The challenge of using ETF charts. (Adam Grimes)

Fund names explained. (Monevator)

Global

Australia cuts interest rates. (FT, MacroBusiness, Money Game)

Smaller Asian stock markets have been on a roll in 2012. (MarketBeat)

Chinese stock performance depends on the index used. (beyondbrics)

Investors are bidding up China closed-end funds. (Focus on Funds)

Economy

The manufacturing slowdown is real. (Tim Duy, ibid also Sober Look)

Auto sales per capita are still way below historical norms. (Avondale Asset)

Mixed media

There is a glut of accelerators and incubators. (Pando Daily)

The iPad Mini is the perfect ‘desert island device.’ (Bits)

The science of gifting. (WSJ)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.