Quote of the day

Dorie Clark, “If you want to have an impact, you might as well be the one setting the agenda by blogging your ideas.” (HBR)

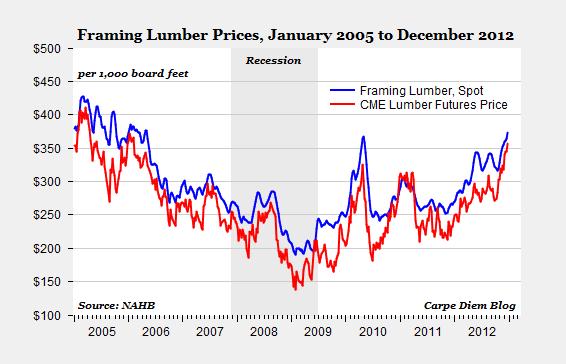

Chart of the day

Lumber prices are at a post-crisis high. (Carpe Diem)

Markets

The market is still dealing with a “sentiment overhang.” (Dynamic Hedge)

So-called safe assets are at present overvalued. (A Dash of Insight)

A look at the S&P 500 vs. capital goods orders. (Pragmatic Capitalism)

Traders are getting way short junk bond ETFs. (MarketBeat)

On the prospect for a bounce back in coal in 2013. (Focus on Funds)

Is there a January effect in broad sectors worth playing? (iShares Blog)

Where markets stand at week-end. (Global Macro Monitor)

Strategy

Insights from a 107-year old stock picker. (Jason Zweig)

Seriously, what is your edge in the markets? (Adam Grimes)

Modern portfolio theory is seriously flawed. (Mercenary Trader)

Apple

Why Apple ($AAPL) could become the next Sony. (The Brooklyn Investor)

Let’s admit it: Steve Jobs was lucky. (Pando Daily)

Companies

Can Google ($GOOG) make headway with a new smartphone? (WSJ also YCharts)

When are stock buybacks good for investors? (WSJ)

Finance

Don’t forget that PNC Financial ($PNC) owns a big slug of Blackrock ($BLK). (Barron’s)

Data mining or insight: Chicago and Boston-based hedge funds outperformed. (HFI via Dealbreaker)

Global

Jim Chanos is adding Brazil to his China short thesis. (Barron’s)

What now for Chinese companies with the US IPO window firmly shut? (Quartz)

Multinationals are finding bargains in Italy. (WSJ, Breakingviews)

European stocks: still cheap. (Barron’s)

Economy

The economy is doing better than you think. (Wonkblog)

The important symbolism of raising taxes on all Americans. (Tyler Cowen)

A look back at the economic week that was. (Bonddad Blog, Calculated Risk)

The economic schedule for the holiday-shortened week. (Calculated Risk)

Earlier on Abnormal Returns

What you missed in our Saturday morning linkfest. (Abnormal Returns)

Top clicks this week on the site. (Abnormal Returns)

Mixed media

Amazon ($AMZN) is cracking down on dodgy book reviews. (NYTimes)

Nassim Taleb’s nice and naughty list. (Dealbreaker)

The “new Web” is a nasty place. (The Reformed Broker)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.