If you haven’t done it already think about signing up for our daily e-mail, thousands of other Abnormal Returns readers already have.

Quote of the day

Noah Smith, “Investing is an area of human endeavor in which copying other people is not a surefire route to success. This makes it different from many other areas of life.” (Noahpinion)

Chart of the day

Markets

The WTI-Brent spread is coming in. (FT)

The sell-side still hates stocks. (Big Picture)

A look at the years in which the S&P 500 never went negative. (Avondale Asset)

Strategy

On the importance of investing checklists from Monish Pabrai. (Market Folly)

Some investing lessons from Sir John Templeton. (Finance Trends Matter)

Short selling bans don’t work. (Turnkey Analyst)

Who is responsible for your savings? You are. (Random Roger)

Companies

Apple ($AAPL) stock is getting shifted from growth to value investors. (WSJ, Blodget)

Dan Pallotta, “The [Apple] critics that are screaming right now are intellectually lazy.” (HBR)

CBS ($CBS) is spinning out its billboard business as a REIT. (WSJ)

Facebook’s ($FB) vision becomes clearer. (Digitopoly)

Why 3-D printing will never go mainstream. (Covestor Blog also Marketwatch)

Finance

SurveyMonkey is in no hurry to do an IPO. (Fortune)

Who is Michael Dell really working for? (WSJ)

Why American companies continue to build up cash on the balance sheet. (FT)

Is Oregon pointing the way for pension funds? (Institutional Investor)

Is a ‘tipping point’ coming for women in hedge funds? (All About Alpha)

Have we solved the ‘too big to fail‘ problem? No. (Andrew Haldane)

Gobank launches. (Felix Salmon)

ETFs

2012 was a good year for target date funds. (Morningstar)

Why ETF fees are likely to continue to drop. (IndexUniverse)

Break out the china, the US ETF industry is 20 years old. (Rick Ferri)

Global

China is losing its edge as the world’s preferred manufacturer. (WSJ)

The US trade deficit with China is not as bad as it seems. (WashingtonPost)

Frontier markets trade at a sizable discount to emerging markets. (beyondbrics)

The critics are out for the Japanese stimulus. (FT Alphaville)

The Bundesbank wants its gold back. (WashingtonPost)

Economy

A big drop in weekly initial unemployment claims. (Calculated Risk, TRB)

Housing starts are surging. (Calafia Beach Pundit, Modeled Behavior, Calculated Risk)

The big ECRI ‘recession is imminent’ call is not looking so hot. (Bonddad Blog)

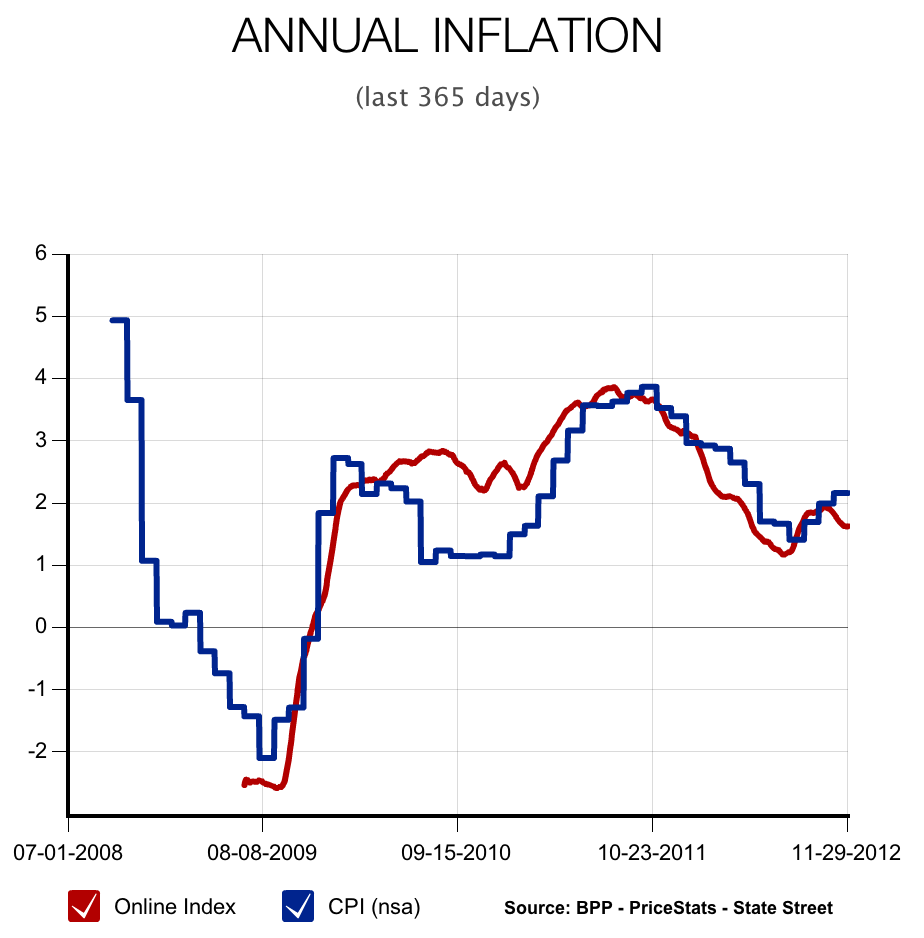

What are independent measures of inflation signaling? (Pragmatic Capitalism)

Rail traffic continues to expand. (ValuePlays)

The Fed is now on the look out for ways in which QE is distorting markets, including farmland and junk bonds. (Bloomberg)

Earlier on Abnormal Returns

A nice review of the Swiss army knife of investment books. (A Dash of Insight)

Mixed media

Why your child likely doesn’t need preschool. (Slate)

China is making a big bet on college education. (NYTimes)

Don’t pay for all of your children’s college education. (Marginal Revolution)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.