Quote of the day

DH, “The effects of the bull market are finally starting to make an impression on market participants. There’s a point where people stop worrying about jack-in-the-box bearish news and start looking at the silver lining. I think we’re there.” (Dynamic Hedge)

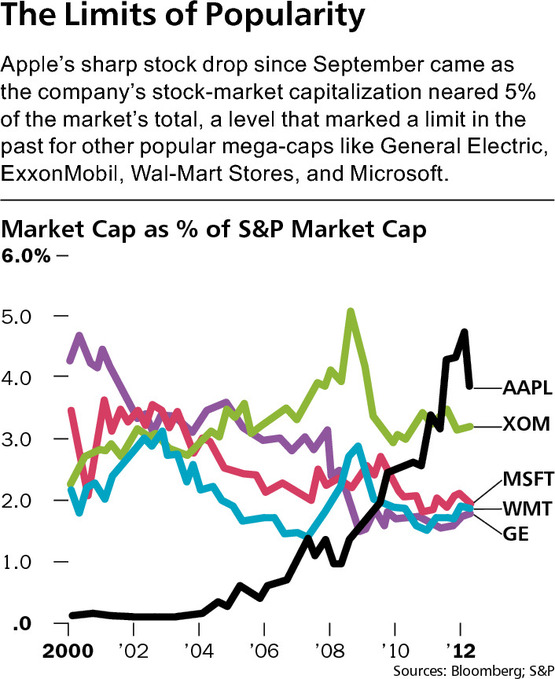

Chart of the day

Only one other stock in recent memory got as big in the S&P 500 than Apple ($AAPL). (Barron’s)

Fear offf

The stock market seems desensitized to the news coming out of Washington. (UpsideTrader)

Investors are finally looking past the “fear factory.” (The Reformed Broker)

Now fund managers are getting excited about stocks. (Horan Capital)

Should the $VIX be even lower? (VIX and More)

Markets

The equal-weighted S&P 500 is once again leading its cap-weighted cousin. (StockCharts Blog)

Things that don’t matter: how you label the current market advance. (A Dash of Insight)

A look at overbought and oversold markets. (Global Macro Monitor)

What’s with the big surge in silver ETF holdings? (Market Anthropology)

Lumber prices are at a 7-year high. (Carpe Diem)

Strategy

Traders need to become comfortable making decisions, any kind of decision. (Joe Fahmy)

The key takeaways from Josh Brown’s Backstage Wall Street: An Insider’s Guide to Knowing Who to Trust, Who to Run From and How to Maximize Your Investments. (A Dash of Insight)

Finance

How “corporate inversions” generate capital gains without a transaction. (WSJ)

Is Wall Street really getting insider dope from Washington-types? (Felix Salmon)

Can Redbox make a go of it in streaming? (Businessweek)

ETFs

What has changed in the twenty years since the launch of $SPY? (IndexUniverse also Random Roger)

Why would any one pay a load for a mutual fund these days? (Barron’s)

Investors are looking for alternatives to money market funds. (WSJ)

Economy

A lot of ex-post analysis at work with the FOMC’s 2007 meeting minutes. (Dealbreaker)

The Fed’s balance sheet is once again growing. (Sober Look)

The only thing the US economy has to fear is its politicians. (Calculated Risk)

Optimism on the budget deficit front. (Money Game, Wonkblog)

As jobs go, so goes the S&P 500. (Carpe Diem)

A look at the week’s economic reports. (Bonddad Blog, Calculated Risk)

The economic schedule for the coming week. (Calculated Risk)

Earlier on Abnormal Returns

What you missed in our Saturday morning linkfest. (Abnormal Returns)

Top clicks this week on the site. (Abnormal Returns)

Mixed media

Kickstarter donors love making moves. (GigaOM)

There is a reason we don’t see a la carte pricing for entertainment. (Sports Economist)

What is middle class in Manhattan? (NYTimes)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.