Quote of the day

Gatis Roze, “Any fool can complicate a methodology. It takes experience and clear thinking to move in the other direction. Investing is often made overly complicated because human nature tends to want to make it so.” (StockCharts Blog)

Chart of the day

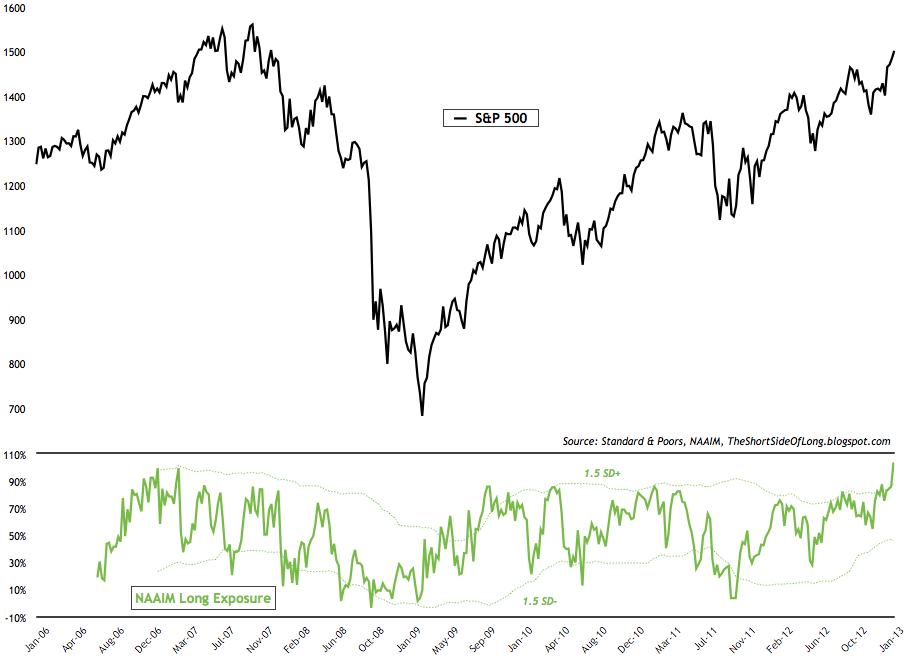

Sentiment measures are showing high levels of bullishness. (Long Side of Short)

Fund flows

The “bubble in cash” is unsustainable. (The Reformed Broker)

What if fund flows in equities have just started? (A Dash of Insight)

Equity inflows hit their highest level since 2000. (AlphaNow)

Don’t forget about the role of reinvested special dividends. (NetNet)

Markets

Keep your eye on a couple of worrisome divergences. (Dynamic Hedge)

The whole world is rallying together. (StockCharts Blog)

What’s your time frame? (All Star Charts also UpsideTrader)

Credit

Credit is absolutely overvalued. (Distressed Debt Investing)

Investors who have loaded up on high yield bonds could be in for a nasty surprise. (Jason Zweig)

Strategy

Four signs your broker is a crook. (NYTimes)

David Merkel, “Wall Street exists to sell promises.” (Aleph Blog)

Investing contests vs. paper trading. (Aleph Blog)

TA-proficient portfolio managers perform in unexpected ways. (Phil Pearlman)

Decomposing the low risk anomaly into micro and macro effects. (SSRN via @quantivity)

Companies

Is Apple ($AAPL) designing products they can’t manufacture? (SAI)

Peak Exxon ($XOM)? (Breakingviews)

Finance

The idea of the ETF has changed a great deal over the past 20 years. (NYTimes also Barron’s)

Public private equity firms are enjoying the new year. (peHUB)

Global

US stocks look expensive relative to the rest of the world. (WSJ)

Europe lags the US in exploiting shale gas. (Economist)

Economy

Why markets liked Friday’s employment report. (Tim Duy)

When Krugman met Weisenthal. (Money Game)

Why is starting a business in the US so complicated? (Slate)

A look back a the economic week that was. (Bonddad Blog, Calculated Risk)

The economic schedule for the coming week. (Calculated Risk)

Earlier on Abnormal Returns

What you missed in our Saturday morning linkfest. (Abnormal Returns)

Top clicks this week on the site. (Abnormal Returns)

What books Abnormal Returns readers purchased in January 2013. (Abnormal Returns)

Football

GE ($GE) is working to find better ways of detecting CTE. (NYTimes)

The brutal physics of football. (Big Think)

Why we care about football. (Seth Godin)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.