Quote of the day

Nassim Taleb, “We’re more fooled by noise than ever before, and it’s because of a nasty phenomenon called “big data.” With big data, researchers have brought cherry-picking to an industrial level.” (Wired)

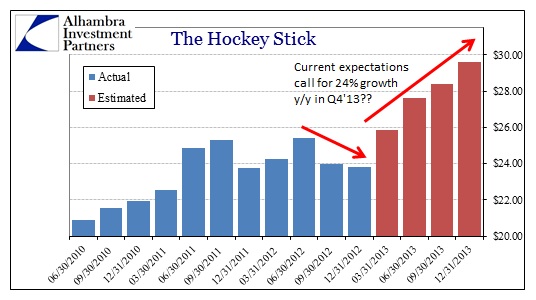

Chart of the day

Why do analysts think earnings are going to take off in the rest of 2013? (research puzzle pieces)

Markets

Keep an eye on the cyclical stocks. (Humble Student)

What happens if bond rates rise? (Ambassador Capital also Horan Capital)

High yield vs. emerging market bonds. (Aleph Blog)

Why the ‘Great Rotation‘ is a misnomer. (FT, Marketwwatch)

Strategy

Five reasons not to buy gold. (Mark Hulbert)

On the difference between diversification and “differsication.” (Jason Zweig)

How survivorship bias affects our estimate of the equity risk premium. (Buttonwood)

You can’t close a valuation gap without a catalyst. (Musings on Markets)

Trading

Gatis Roze, “The stock market is always one step ahead of you. The sooner you accept this fact, the better for your trading results.” (StockCharts Blog)

On the parallels between grilling and trading. (Dragonfly Capital)

What constitutes a ‘trading edge‘? (Mercenary Trader)

Companies

Facebook ($FB) is destined for a life of mediocrity. (Pando Daily)

LinkedIn’s ($LNKD) success is even surprising the company. (The Fiscal Times)

What is you applied a David Einhorn plan to Microsoft ($MSFT)? (In Pursuit of Value)

How to create your own Apple ($AAPL) stub. (The Brooklyn Investor)

Dell

Dell ($DELL) will not go private without some shareholder opposition. (Dealbook, Barron’s)

Is Michael Dell’s legacy driving his decision t0 take the company private? (NYTimes)

A buyout will not necessarily solve any of Dell’s problems. (Economist)

Analysts

Why do analysts consistently herd? (NYTimes)

Do analysts pay much attention to their long-term earnings growth rates? (research puzzle pix)

Why Wall Street stopped covering small stocks. (peHUB)

Finance

Why do institutional investors keep investing in private equity? (Economist)

How one deep value manager goes global. (Distressed Debt Investing)

Is a reliance on money market funds making banks more unstable? (Real Time Economics)

M&A

The M&A cycle seems to be turning up. (Economist)

Chinese companies continue to spend on US companies. (WSJ)

Funds

WisdomTree Investments ($WETF) trades at a big premium to other money managers. (Barron’s earlier Abnormal Returns)

When funds get too big to manage successfully. (Mindful Money)

ETF launches slowed in January. (Invest With an Edge)

Immigration

How economics has benefited from immigration. (NYTimes)

Will the tech world finally get startup visas? (Pando Daily)

Economy

Is there realistic hope for a budget compromise? (A Dash of Insight)

Gasoline prices are on the rise. (Sober Look, SurlyTrader)

A look back at the economic week that was. (Bonddad Blog, Calculated Risk)

The economic schedule for the coming week. (Calculated Risk)

Earlier on Abnormal Returns

What you missed in our Saturday morning linkfest. (Abnormal Returns)

Top clicks this week on the site. (Abnormal Returns)

Mixed media

Can you run a family like a business? (WSJ)

Which tax preparation software is best for you? (NYTimes)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.