Quote of the day

Scott Adams, “The robot future is fundamentally unpredictable. But a good start is assuming all straight-line predictions are incorrect.” (Dilbert.com)

Chart of the day

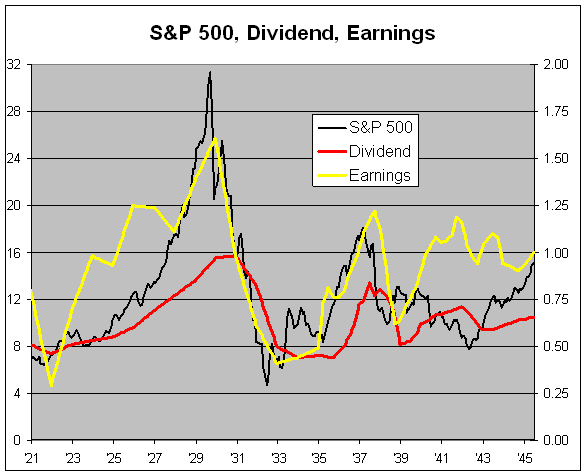

How overpriced were stocks in 1929? (Crossing Wall Street)

Markets

Signs of a slowdown in momentum. (Dynamic Hedge)

Bridgewater Associates is shifting money into equities and commodities. (Bloomberg)

How do secular bear markets end? (Big Picture)

About that earnings acceleration for 2013. (Crossing Wall Street)

Is tech really underperforming? (Bespoke)

Is it time for large value to start outperforming again? (Capital Spectator)

Junk bonds

Just how overvalued is high yield? (Unexpected Returns)

Junk bond covenant quality is hitting new lows. (Income Investing)

Companies

Peak price/sales ratios of some recently broken growth stocks. (Avondale Asset)

Why Apple ($AAPL) should ignore its shareholders. (Felix Salmon contra FT)

How much does Google ($GOOG) pay Apple to be the default search engine on iOS? (Fast Company, ReadWrite)

How should Dell ($DELL) shareholders react to the buyout? (Musings on Markets)

Slot machine giant IGT ($IGT) has an activist shareholder on its bad side. (Clusterstock)

Finance

Why individuals continue to trade on inside information. (Dealbook)

There is a big private equity shakeout coming. (Bloomberg)

Alternative investments are rapidly becoming mainstream with institutions. (Institutional Investor)

Blackstone Group ($BX) is looking to add more stakes in hedge fund managers. (Bloomberg)

ETFs

How ETFs act as price discovery vehicles during market holidays. (iShares Blog)

The ETF Deathwatch for February 2013. (Invest with an Edge)

Global

Japan is playing a dangerous game by trying to suck investors into the stock market. (Pragmatic Capitalism)

There no shortage of chasing in the Japanese stock market at the moment. (research puzzle pix)

A slowdown is coming to Australia. (Quartz)

Economy

Small business optimism is up but still low. (RTE, Calculated Risk)

Renters are still driving the housing market. (Fortune)

Earlier on Abnormal Returns

A Q&A with Wes Gray, co-author of Quantitative Value: A Practitioner’s Guide to Automating Intelligent Investment and Eliminating Behavioral Errors. (Abnormal Returns)

Mixed media

Does anyone really want to “pay by Tweet“? (Digits)

How the Sonos Playbar came to be. (GigaOM)

NextDoor, a network of neighborhoods, has attracted some high-profile backers. (Pando Daily, Bits)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.