Quote of the day

Buttonwood, “Plenty of banks and brokers pay great attention to cross-border money flows rather like Roman augurs sorting through chicken entrails for indications of the future. But a note from Jeffrey Rosenberg at BlackRock points out that the causation goes the other way…In other words, flows follow returns, not the other way round.” (Economist)

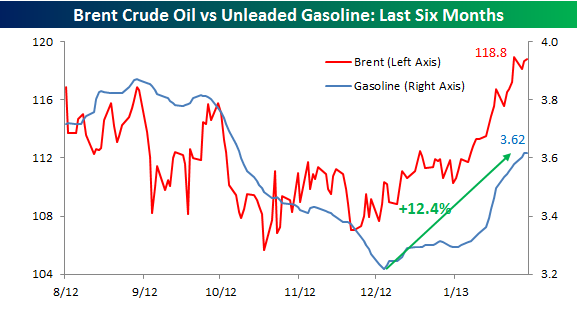

Chart of the day

Gasoline prices keep rising. Why? (Bespoke also Econbrowser)

Markets

The market is particularly calm of late. (Bespoke)

Warren Buffett’s favorite market indicator has exceeded parity. (Pragmatic Capitalism)

The ‘great rotation‘ is coming from cash not bonds. (Income Investing)

Are equities here and in Europe ‘unambiguously cheap‘? (Big Picture)

Strategy

Why investors should focus on total shareholder yield (dividends+share buybacks). (Fortune)

More on all-weather sector-based portfolios. (CSS Analytics)

Temporary vs. eternal: where should traders focus? (MarketSci Blog)

Can following accomplished traders make you more money: real-money test. (Quartz)

Companies

GE ($GE) is not messing around with its share buybacks. (WSJ, Reuters)

Does Berkshire Hathaway have a variable annuity problem? (Aleph Blog)

Maybe JC Penney ($JCP) just can’t be saved. (Quartz)

Seth Klarman is done with HP ($HPQ). (Term Sheet)

Apple ($AAPL) is likely rebuilding iOS and should embed it everywhere. (GigaOM, ReadWrite)

High frequency trading

Maybe high frequency trading, per GETCO, isn’t all it is cracked up to be. (Dealbook also Marketwatch)

How investors can use HFT to their advantage. (Falkenblog)

Deals

Berkshire Hathaway ($BRKB) teams up to buy Heinz ($HNZ). (WSJ, Bloomberg, Quartz)

Warren Buffett will not have an active role in the company. (Market Folly)

Did the buyer group overpay for Heinz? (Crossing Wall Street)

Bankrupt American Airlines and US Air ($LCC) make it official. (Dealbook, Bloomberg, WSJ)

ETFs

Low vol is coming to small and mid-cap indices. (IndexUniverse)

When a high-profile fund manager goes wrong. (research puzzle pix)

Global

Ugly GDP reports from Europe and Japan. (FT Alphaville, Free exchange, Quartz, FT)

Macro hedge funds have cleaned up on the ‘Abe trade.’ (FT, ibid)

Either the FTSE or Sterling is mispriced. (The Source)

Switzerland seems to have its own residential real estate boom. (Dealbook)

Economy

Weekly initial unemployment claims continue to inch lower. (Calculated Risk, Capital Spectator, Bonddad Blog)

Farmland prices, drought or not, continue to soar. (Money Game)

Social media

LinkedIn ($LNKD) likes you, it really likes you. (Nancy Miller)

On the rise of the social VC. (peHUB)

Mixed media

On the similarities between “trading” in financial markets and online dating. (Wonkblog)

Eight reasons city life beats the suburbs. (Brett Arends)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.