This is a late edition of the daily linkfest. Hope you have a nice holiday.

Quote of the day

Jean-Marie Eveillard, “Most people aren’t cut out for value investing, because human nature shrinks from pain..” (WSJ)

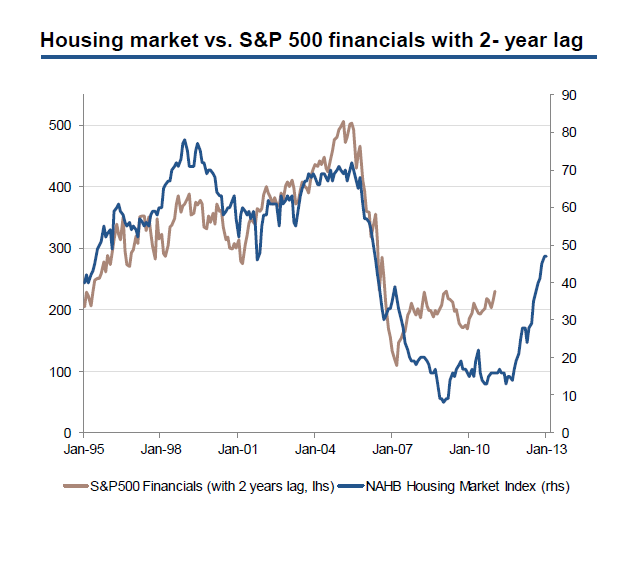

Chart of the day

Past as prologue? (World Beta)

Markets

Why a pullback would be a positive development. (Dynamic Hedge)

Investors are now fleeing junk bond funds. (FT)

China is overbought, gold oversold. (Global Macro Monitor)

Strategy

Bernard Baruch’s 10 rules of investing. (The Reformed Broker)

On the role of TIPs in a “permanent portfolio.” (Total Return)

Short-sellers make money because they anticipate future poor fundamentals. (SSRN via @quantivity)

The capital gains tax picture is decidedly more complex these days. (WSJ)

Companies

Why Warren Buffett got hitched to Heinz ($HNZ). (Dealbook)

Things can only get tougher for business development companies (BDCs). (Sober Look)

The tech industry badly wants to get into virtual gambling. (NYTimes)

Finance

Regulators are sniffing around dark pools. (WSJ)

The very different tale of two publicly traded money managers. (InvestmentNews)

Economy

A look back at the economic week that was. (Bonddad Blog, Calculated Risk)

The economic schedule for the coming week. (Calculated Risk)

Earlier on Abnormal Returns

What you missed in our Saturday morning linkfest. (Abnormal Returns)

Top clicks this week on the site. (Abnormal Returns)

Mixed media

How to time your Apple hardware purchase. (GigaOM)

The changing value of Twitter for investors. (Interloper)

What does the Maker’s Mark decision tell us about the power of social media? (Quartz, Wonkblog)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.