If you haven’t done it already think about signing up for our daily e-mail, thousands of other Abnormal Returns readers already have.

Quote of the day

Martin Wolf, “Those who believe the eurozone’s trials are now behind it must assume either an extraordinary economic turnaround or a willingness of those trapped in deep recessions to soldier on, year after grim year. Neither assumption seems at all plausible.” (FT)

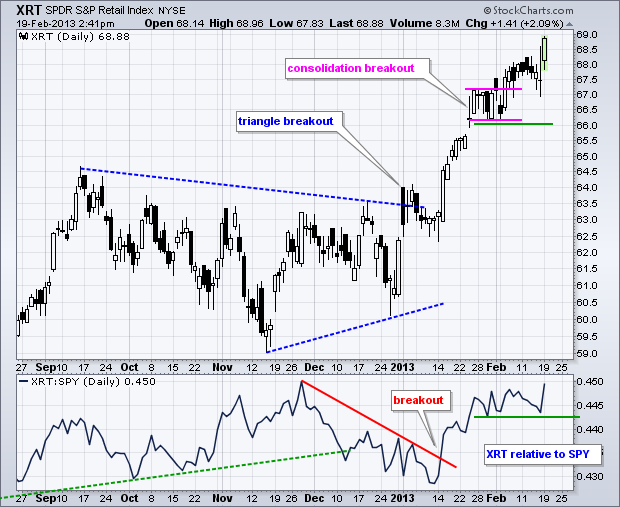

Chart of the day

Retail stocks are back at new highs. (StockCharts Blog)

Markets

Why gold is going lower. (Money Game, Buttonwood’s notebook, MarketBeat, Big Picture)

Is skew signalling a market pullback? (SurlyTrader)

What stocks the “ultimate stock pickers” are buying now. (Morningstar)

Companies

Why you shouldn’t get too excited about a Office Depot ($ODP)/OfficeMax ($OMX) deal. (The Atlantic, Deal Journal)

Apple ($AAPL) is thinking bigger than a TV. (CNBC)

How has Berkshire Hathaway ($BRKA) stock done over the past twenty years? (Bespoke)

How Buffett wins in the Heinz ($HNZ) deal. (Aleph Blog)

Finance

How did private equity do during the financial crisis? (Term Sheet)

Institutional investors are giving up on commodities. (FT)

Lending Club may be a victim of its own success. (Learn Bonds)

Hedge funds

Want to get a job at a hedge fund? “Be of value.” (World Beta)

Seth Klarman’s hedge fund is opening up just a little bit. (II Alpha)

The ‘GLG-ification of Man Group‘ is nearly complete. (Dealbreaker)

ETFs

How did the Pimco Total Return ETF ($BOND) do in its first year? (YCharts Blog)

What’s the idea behind the Forensic Accounting ETF ($FLAG)? (ETFdb)

Global

The Kiwi is overvalued. (FT Alphaville, Bloomberg)

On the parallels between the UK and Japan. (Bespoke)

The pressure on the Bank of Japan remains. (Tim Duy)

India’s growth problems in detail. (Bonddad Blog)

Economy

Single-family home starts rise to a four-year high. (Calculated Risk, Bloomberg, Wonkblog)

Architecture billings are surging. (Money Game, Calculated Risk)

Mixed media

An increasing number jobs require a college degree. (NYTimes)

Should you work for free? Maybe. (Seth Godin)

How to be more productive? Work in 90 minute increments. (Farnam Street)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.