Quote of the day

Michael Pettis, “Large banks prefer stability to rapid growth, and US banks are now so large that they can impose their preferences on to the US economy.” (FT)

Chart of the day

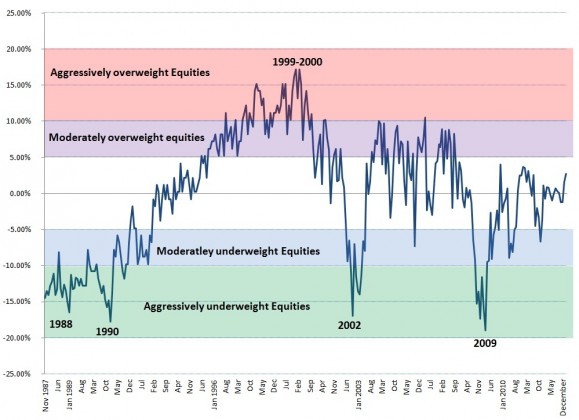

AAII sentiment does not point towards a top. (Big Picture)

Markets

It’s not fair to say the stock market is all about the Fed. (TheArmoTrader)

The markets for now have “crisis fatigue.” (Adam Warner)

Global financial stress is growing. (Money Game)

Decision making

What number(s) do you track? (Bucks Blog)

More choices lead to bigger gambles. (Futurity)

How advisers should deal with today’s “emotionally reactive” clients. (AdvisorOne)

Four steps to better decision making from Decisive: How to Make Better Choices in Life and Work. (Farnam Street)

Finance

CalPERS may switch from active to index management. (InvestmentNews)

Why US companies need to go public earlier. (Quartz)

Global IPO volume is up in 2013. (FT)

Dell

Southeastern Asset Management is a big player in the Dell ($DELL) drama. (WSJ)

Why Dell shareholders should fear a stub. (Dealbook, Breakingviews)

Dell could very well go forward without Michael Dell. (Bloomberg)

There seems to be some value in the Dell’s IP portfolio. (Businessweek)

ETFs

A look back at a year in the life of the Pimco Total Return ETF ($BOND). (research puzzle pix)

Global

Daniel Gross, “Banking is complicated. But what happened in Cyprus was relatively simple.” (The Daily Beast)

Countries aren’t corporations. (HBR)

Economy

Case-Shiller shows a continued rebound in house prices. (Calculated Risk)

A lot of workers didn’t recognize payroll tax increases. (Wonkblog, Real Time Economics)

Earlier on Abnormal Returns

Twitter as the ultimate dopamine dispensary. (Abnormal Returns)

Alternative investments are no longer all that alternative. (Amazon Money & Markets)

Mixed media

The Summly deal makes no sense for Yahoo! ($YHOO). (Vibhu Norby also FT, WSJ)

The best stock picker I ever knew. (Jeff Matthews)

Why you shouldn’t dismiss the crowd so lightly. (Seth Godin)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.