Quote of the day

William Bernstein, “I would say the expected return of the average balanced portfolio with a prudent investment policy—half stocks, half bonds—is as low as it’s ever been.” (IndexUniverse)

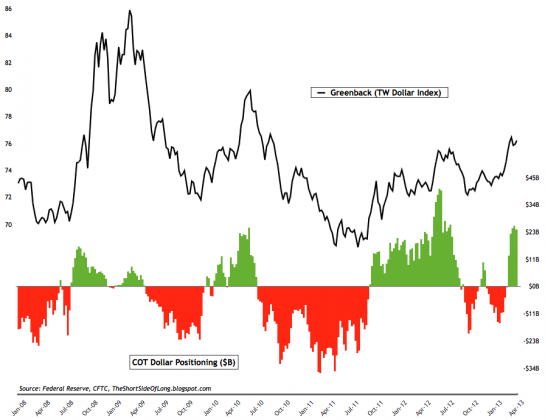

Chart of the day

Hedge funds are long the US dollar against just about everything else. (The Short Side of Long)

Markets

Market breadth is none too hot. (Bespoke)

Why are defensive sectors leading the stock market? (MarketBeat)

What are individual investors doing raising cash? (Phil Pearlman)

Did the ‘Great Rotation‘ ever really happen? (Learn Bonds)

Farmers are cutting back on rice production. (WSJ also FT)

Strategy

Why you can’t avoid the topic of asset allocation. (Capital Spectator)

Time to do some spring cleaning of your pundit portfolio. (Big Picture)

Don’t be an entitled trader. (SMB Training)

Quants

Quantopian wants to democratize algorithmic trading. (Pando Daily)

How do you get a quant job on Wall Street? (Quartz)

Companies

Tiffany ($TIF) is vulnerable to a weakening global economy. (SumZero)

Why companies are filling out their “advice portfolios.” (HBR also The Atlantic)

It seems that Vodafone ($VOD) is in play. (FT Alphaville)

Apple

Apple ($AAPL) has got to be working on some “moonshots”, right? (Businessweek)

Is Apple too big to succeed? (Above the Market)

Why Apple may be putting in some kind of bottom. (Barron’s also chessNwine)

People still love reading about Apple. (Minyanville)

Apple missed an important anniversary. (Fortune)

Finance

On the parallels between baseball and Wall Street. (Michael Santoli)

Nasdaq ($NDAQ) is getting into the bond trading business. (Dealbook, FT)

What is Blackstone ($BX) doing in the Dell ($DELL) deal? (Dealbook)

Why haven’t we seen a surge in M&A activity? (WSJ)

Tweeting

What to make of Tesla’s ($TSLA) tweets? (Dealbook)

Does tweeting make for deeper markets for small cap stocks? (SSRN via peHUB)

Funds

Checking in with some small cap managers holding a big slug of cash. (Mutual Fund Observer)

Should you buy equity funds from a bond fund star? (Marketwatch)

ETFs

Are free ETFs on their way? (FT contra Focus on Funds)

USAA is jumping into the active ETF game. (IndexUniverse)

BDCs are just one of the many ways investors have reached for yield. (research puzzle pix)

Global

Is Australia topping out? (Bonddad Blog)

No wonder the Euro economy is weakening. (Charts etc.)

Economy

State budget surpluses are “blooming.” (Daniel Gross)

The US labor market is getting thinned out. (Marginal Revolution, FT)

Housing

Three myths about the housing market rebound. (Real Time Economics)

Fannie Mae is printing money once again. (Calculated Risk)

Why it is still hard to get a mortgage. (Real Time Economics)

Energy

Cheap US gas is attracting investment from overseas. (WashingtonPost)

Have we reached “peak oil demand“? (FT)

Decisions

NS, “Importantly, no one is immune to the biases that lead to stupid decisions.” (New Scientist)

Bryan Goldberg, “You are not as good as you think you are.” (Pando Daily)

Mixed media

Why startups shouldn’t hire MBAs. (Vivek Wadhwa)

Comparing two new meal delivery services. (Pando Daily)

Is Twitter too much of a time suck? (Wonkblog contra Slate, Free exchange)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.