Quote of the day

Doug Kass, “Learn to survive under adverse market conditions by avoiding large losses, and learn how to prosper during good times. Generally speaking, by maintaining discipline and stopping out your losses, you can live another day in your investing life. ” (TheStreet)

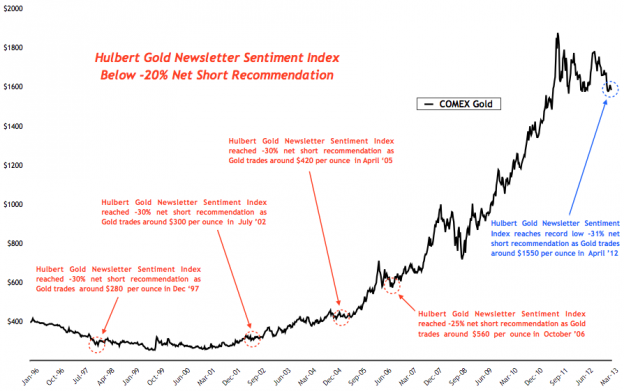

Chart of the day

Gold sentiment is really bearish. (The Short Side of Long)

Markets

How to measure a reaction to earnings: price action. (Adam Warner)

Speaking of rotation, the defensive sectors are on fire. (All Star Charts, ETF Trends)

Investors have stopped putting money into banks. (Mark Hulbert)

Commodities

Investors are rotating out of commodities. (Big Picture)

Lumber prices are now near the housing bubble highs. (Calculated Risk)

Are miners a value trap? (MacroBusiness)

Gold miners are oversold. (Minyanville)

Strategy

Think about rebalancing as a risk management strategy more than a return-enhancing tool. (Capital Spectator)

Talking about your investment process does not constitute investment advice. (Humble Student)

There are no shortage of “trading hurdles” you need to overcome. (RogueTraderette)

On the problems with ‘Sell in May.’ (MarketSci Blog, Rick Ferri)

Life (and investing) can be so random. (Above the Market)

Technology

Silicon Valley is a winner-take-all environment. (Pando Daily)

The fate of Aereo will be decided in the courts. (WSJ, WashingtonPost)

The downsides of Google Fiber. (GigaOM)

Are more pixels always better? (Scientific American)

JC Penney

JC Penney ($JCP) goes back to the future. (Dealbook, Daniel Gross, TRB, Time)

JC Penney bonds are trading at a big discount to par. (Fortune)

JC Penney was the wrong vehicle for Johnson’s ideas. (SplatF)

Will Ron Johnson go back to Apple ($AAPL)? (Term Sheet, Deal Journal)

Insider trading

When does “political intelligence” cross over into insider trading? (Dealbook)

Insider traders love to “hide” their trades in their children’s accounts. (Planet Money)

Auditors are not free of insider trading. (Quartz)

Fannie and Freddie

At what point does Fannie and Freddie’s profits embarrass Washington? (Businessweek)

Speculators just can’t help playing the remaining Fannie and Freddie securities. (Bloomberg)

Bitcoin

Izabella Kaminska, “Money may be memory. It may even be a belief system. But it is also a system of real-wealth allocation.” (FT Alphaville)

Building a better Bitcoin. (Justin Fox)

Economy

The consumer has not given up yet. (Money Game)

Some good news on the jobs front. (Global Economic Intersection)

What if the Fed ended the ‘war on savers‘? (Martin Fridson)

Europe needs a “new growth idea.” (Money Game)

Energy

How quickly is natural gas getting into the transportation system? (Bonddad Blog)

Just how much trouble is the US coal industry? (Wonkblog)

College

Selective US colleges are in the wrong places. (Economix)

Is economics a “Mickey Mouse major”? (EconLog)

When cheating comes to college quiz bowl competitions. (Slate)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.