Quote of the day

Samuel Lee, “The best investors talk about being keenly aware of what they know and don’t know. Mediocre or dishonest investors pretend they know. Bad investors don’t even know they don’t know.” (Morningstar)

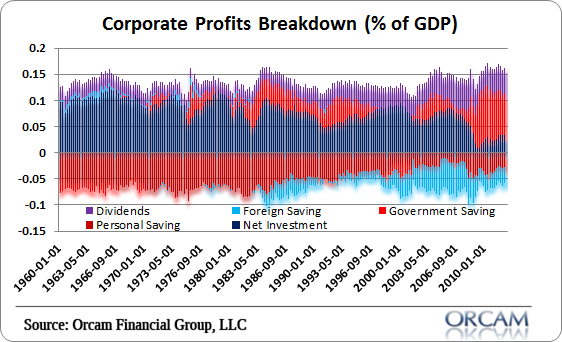

Chart of the day

A breakdown of corporate profits over time. (Pragmatic Capitalism)

Markets

New highs are confirming recent market strength. (The Reformed Broker)

The most recent AAII sentiment survey shows widespread market skepticism. (Phil Pearlman, chessNwine)

Is now the time for emerging markets to play some catch up? (Global Macro Monitor)

Sectors

Gold has lost its luster for many as a safe haven. (NYTimes)

Have homebuilder valuations gotten too rich? (FT)

Airlines are cuing off of crude oil prices. (Charts etc.)

Strategy

Take talk about “constants” in investing with a big grain of salt. (Crossing Wall Street)

Check out the spread between $SPLV and $SPHB. (MarketSci Blog)

On the parallels between golf and trading. (Kirk Report)

Study finds investors are risk averse. (InvestmentNews)

Companies

Operating leverage is underrated. (MicroFundy)

Microsoft ($MSFT) investors hate to see PC sales plunging. (GigaOM)

Finance

Foursquare takes on convertible debt in a bid to grow. (Businessweek, A VC)

Are taxes on carried interest finally going to change? (Term Sheet, NetNet)

ETFs

On the harsh math of mutual fund fees. (Rick Ferri)

A review of the “private equity funds for the masses.” (Morningstar earlier Abnormal Returns)

A look at the ETF-ization of gold. (Money Game)

We live in an era of ‘cheap beta.’ (IndexUniverse)

Global

Is Japan ready to embrace private equity? (Quartz)

Are robots taking our jobs or not? (FT Alphaville)

Greece is starved for capital. Some hedge funds are rushing in. (Bloomberg)

Brent has displaced WTI as the oil benchmark of choice. (FT)

Redoing the Big Mac Index using The Economist instead. (Quartz)

Economy

Weekly initial unemployment claims continue to show improvement. (Calculated Risk, Capital Spectator)

Have you noticed what is going on with the deficit? (Daniel Gross, Calculated Risk)

Checking in on the housing market recovery. (Bonddad Blog)

What’s it going to take for the Fed to continue QE? (Tim Duy)

The US labor market is improving ever so slowly. (Conversable Economist)

Bitcoin

Great engineers are not great economists. (Pando Daily)

What is Bitcoin good for? (Felix Salmon)

Eric Posner, “Yet history shows that private currencies always end in tears; if central banks sometimes abuse the trust we place in them, the alternatives are worse.” (Slate)

Mixed media

Welcome to the micro-gig economy. (The Atlantic)

Social media comes to healthcare. (Fortune)

Creating the perfect hyperlocal social network. (ReadWrite)

The economics of Amazon Subscribe and Save toilet paper. (Freakonomics)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.