Quote of the day

Dan Solin, “For too many years, CNBC has provided a disservice to investors by feeding their gambling instincts. It’s comforting to see that the gig is (almost) up.” (USNWR via TalkingBizNews)

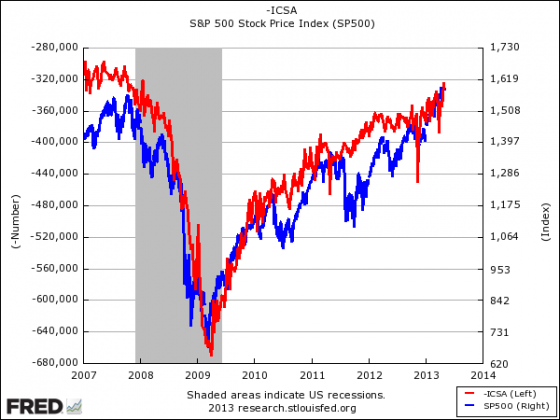

Chart of the day

The stock market continues to track initial jobless claims. (Money Game)

Markets

Sometimes you need to be reminded it is a bull market. (Chicago Sean)

Something’s gotta give. (MicroFundy)

How long it took to go from 1500 to 1600 on the S&P 500. (MoneyBeat)

You can make a chart do just about anything. (The Reformed Broker)

Strategy

Can you really use Google Trends to generate profits? (Turnkey Analyst)

Gatis Roze, “Rigidity is kryptonite to a trader.” (StockCharts Blog)

Investors need to protect their emotional capital as well. (Dumb Money)

Why your backtested ‘profits’ are not likely to turn up in real life. (Mortality Sucks)

You can’t have “cognition without emotion.” (WSJ)

Companies

Did you know there was a hedge fund-backed REIT focused on buying up foreclosed homes? (YCharts Blog)

What does it mean when “premium YouTube channels” can be acquired? (Pando Daily)

Square knows where you have spending your money, which beats a check-in any day. (The Verge)

Berkshire Hathaway ($BRKB)

What is Doug Kass going to ask Warren Buffett? (Dealbook)

Warren Buffett isn’t afraid to pay (big) for performance. (WSJ)

How to value Berkshire. (Morningstar)

Finance

How mortgage credit quality has increased since the financial crisis. (The Basis Point)

There is still a chance prime money market funds will get some enhanced regulation. (WSJ)

Another alternative asset managers, Ares Capital, is coming public. (Reuters, FT)

Small banks are a dying breed. (Quartz)

ETFs

How did the 100 biggest ETPs do last month? (ETF Replay)

The worst ETF bets of 2013. (IndexUniverse)

ETF stats for April 2013. (Invest with an Edge)

Global

Abenomics has been a boon to the hedge fund crowd. (FT)

Why the RBA is likely to lower interest rates. (Sober Look)

Does the ECB have any cards left up its sleeve? (Gavyn Davies)

Economy

Non-farm payrolls, after taking into account revisions, shows an improving jobs picture. (Calculated Risk, Bonddad Blog, Wonkblog, Quartz)

No great shakes from the April ISM Non-manufacturing report. (Calculated Risk, Global Economic Intersection)

Rail traffic is weakening. (Pragmatic Capitalism)

Revisiting the Laffer Curve for corporations. (Aleph Blog)

STOCK Act

Where’s the outrage over the repeal of a big chunk of the STOCK Act? (CJR)

Washington insiders are acting like the STOCK Act never passed. (WashingtonPost)

Mixed media

Ten failed technology predictions. (Above the Market)

If SMS is dying, what app is going to take its place? (The Verge)

Essential (finance) follows on Twitter. (Alpha Capture)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.