Quote of the day

Jason Zweig, “Bond investors who are over the age of, say, 55 know firsthand that bonds don’t always generate positive returns.” (Total Return)

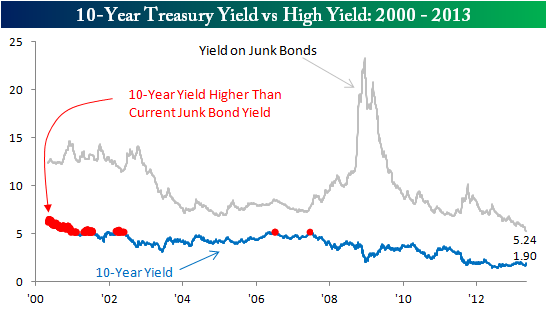

Chart of the day

High yield bonds yield less today than Treasuries did five years ago. (Bespoke also Learn Bonds)

Markets

It has been 177 days since the market experienced a 5% correction. (Pragmatic Capitalism also UpsideTrader)

GMO is now sitting in 50% cash. (Market Folly)

A look at the evolution of S&P 500 earning estimates. (Dr. Ed’s Blog)

David Tepper is “definitely bullish.” (MoneyBeat, Pragmatic Capitalism)

Commodities

The stocks-commodities disconnect is growing. (FT Alphaville, Free exchange)

Why is lumber correcting so hard? (Financial Iceberg)

The Saudis welcome the shale boom. (FT)

Strategy

In investing, as in soccer, there is a big difference between activity and results. (Bucks Blog)

How volatility affects our investing behavior: hello buy-and-hold! (The Reformed Broker)

Looking forward to reading Meb Faber’s new book Shareholder Yield: A Better Approach to Dividend Investing. (Amazon)

Companies

What’s the deal with Amazon Coins? (Pando Daily)

Netflix ($NFLX) has figured things out…for now. (Justin Fox)

Square is reinventing the cash register. (Fortune, AllThingsD)

TransferWise jumps into the money transfer business. (Quartz)

Hedge funds

Dan Loeb wants to break up Sony ($SNE). (Dealbook, Breakingviews)

A quantitative UK-based hedge fund has launched with much lower fees. (Dealbook)

Notes from the 2013 London Value Investor Conference. (Market Folly)

Finance

Residential REITs are going to come to market fast and furious. (FT)

Brokerage firms are ‘extincting themselves.’ (InvestmentNews)

Marc Andreesen thinks more companies should come public with dual class shares. (peHUB)

Should we end small cap decimalization? (Term Sheet, Felix Salmon)

Bloomberg snooping: the fallout. (NYTimes, FT, Wonkblog, NetNet)

ETFs

Three new ETFs that target total “shareholder yield.” (Turnkey Analyst, IndexUniverse, ETF Trends)

Vanguard will launch its emerging market bond ETF in June. (IndexUniverse)

Fidelity has been cleared to launch actively managed ETFs. (ETF Trends)

Global

How should we think about Abenomics? (Tim Duy)

The European project is losing favor among the young. (FT Alphaville)

Not among the Germans however. (Money Game)

Is a thaw in Greek finance finally here? (MoneyBeat)

Is the idea of the BRICs finally over? (WSJ)

The Odd Couple trade: short Aussie, long the Mexican peso. (WSJ)

Big trends

World birthrates are falling faster then previously thought. (Wonkblog)

The implications of the new robotic age. (Mother Jones also Modeled Behavior, Wonkblog)

Earlier on Abnormal Returns

In praise of doing the opposite of your investment instincts. (Abnormal Returns)

An interview with me on a range of topics including HFT and the future of blogging. (QuantConnect)

Mixed media

North Carolina is not crazy about Tesla’s ($TSLA) direct-to-consumer business model. (Slate)

The NTSB is recommending a lower BAC level from .08 to .05. (Bloomberg)

Eleven things that make you a bad driver. (Mental Floss)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.