True, long-lasting innovations ares a rare thing in the world of finance. In my book I argue that the introduction of the ETF or exchange-traded fund was exactly that. It has taken two some decades but we are now seeing real changes in how people invest due to ETFs. I wrote:

Like all upheavals, the ETF revolution has both its benefits and its drawbacks. On the whole, ETFs have made investing easier, more diverse, and cheaper. On the other hand, the introduction of ETFs has changed the actual underlying nature of some markets, and the rapid introduction of new ETFs has diluted the benefits seen early on. Unlike many revolutions, we are not likely to see a counterrevolution unseating the ETF regime any time soon.

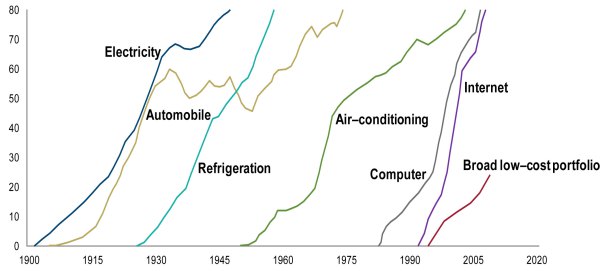

You can see how the introduction of ETFs has driven the adoption of “broadly diversified, low-cost portfolios.” Joe Davis and Andy Clarke at the Vanguard Blog compare the rise of these portfolios to other “great ideas. They write:

The adoption of great ideas typically follows an “S” curve, starting slowly, then accelerating. Eventually, the great idea becomes commonplace. The adoption of the “broad low-cost portfolio” seems to be following this pattern.

Source: Vanguard

They note that we are still in the “second or third” inning of this process. Of course there is a limit as to just how much of the asset management industry can (or will) shift towards this approach. To be clear the definition of these portfolios is low cost, not necessarily indexed. In any event if too much money becomes indexed there should be a resulting increase in opportunities to generate alpha.

Josh Brown at the Reformed Broker notes this very point:

By the way, the ultimate irony of this rush into index products and plain vanilla beta is that excellent opportunities will be created for active managers by the competitive vacuum. Inefficiencies will once again become bountiful in the absence of people looking for them – stockpickers will find themselves alone on the beach, metal detector in hand, once again.

The point in all of this is that investors can get, at least for now, the best of both worlds. Investors who pursue broadly diversified portfolio made up with funds with rock bottom fees have the potential to generate above average returns with a relatively modest investment in time and effort. As I wrote in a prior post on the high cost of active management:

Time spent trying to find that above average active fund is time not spent in other pursuits. There will always be investors in hot pursuit of what is working now. Which is great. They are in a very real sense doing us all a favor. However for the vast majority of investors a simple, stripped down, low-cost approach to investing is in some sense the best of both worlds. It has the potential to generate above average, albeit mediocre, returns while avoiding the high implicit (and explicit) costs of active investment strategies.

This approach is above all a commitment to building simple portfolios. This is contrast to the thrust of nearly the entire money management industry which is trying to push investors into more complex products with higher fees. In a very real sense individual investors can outperform those “professional investors” who are constantly in search of the hot new manager. Morgan Housel at the Motley Fool puts it well:

3. Simple is usually better than smart

Someone who bought a low-cost S&P 500 index fund in 2003 earned a 97% return by the end of 2012. That’s great! And they didn’t need to know a thing about portfolio management, technical analysis, or suffer through a single segment of “The Lighting Round.”Meanwhile, the average equity market neutral fancy-pants hedge fund lost 4.7% of its value over the same period, according to data from Dow Jones Credit Suisse Hedge Fund Indices. The average long-short equity hedge fund produced a 96% total return — still short of an index fund.

Investing is not like a computer: Simple and basic can be more powerful than complex and cutting-edge. And it’s not like golf: The spectators have a pretty good chance of humbling the pros.

Even though simple investing strategies have worked well over time relative to more complex ones the constant drumbeat is difficult to resist. Larry Swedroe at CBS Moneywatch recently highlighted a paper by Robert Maynard that makes this point in great detail and provides investors with the framework to rebut those who feel that a endowment-style portfolio management approach that emphasizes illiquid, opaque alternative investments is the way to go. Maynard writes:

Conventional investing has proved its worth for a number of decades, and has survived many tests. The endowment model failed its first big test, and comes with many additional problems as well. There is little reason for sophisticated institutional investors to feel compelled by the media or the anecdotal promises of its advocates to travel down that path.

The same can be said for individual investors as well. The opportunity to build a diversified portfolio are out there. Swedroe sums up the paper like this:

The bottom line is that while diversification of risks is the central tenet of prudent portfolio construction, investors can obtain all the diversification they need through publicly available vehicles. They don’t need the complexity or the high expenses of actively managed, private alternative investments to build highly diversified portfolios. By investing in publicly available funds, they maintain total transparency and have daily liquidity. This is important because the benefits of diversification are greatest when you can rebalance, which can be done only if you have liquidity.

Rebalancing is a key to this kind of uncomplicated approach to investing. However just because something is simple does not mean that it is easy. Portfolio rebalancing forces investors to sell those assets that have increased in value and buy more of those that have recently declined. This is for many a psychologically difficult exercise. Then again, a disciplined approach like this is likely to outperform one that is based on trying to jump from hot manager to hot manager.

The world of investing seems like it is becoming ever more complex. Investors can either choose to pursue complexity and with it higher costs and increasing effort. Or they can take a step back, as we often do at the beginning of the year, and choose a simple, uncomplicated approach to investing that is due to innovation has become cheaper and more freely available to investors than ever before.

Items mentioned above:

Abnormal Returns: Winning Strategies from the Frontlines of the Investment Blogosphere. (Amazon)

The adoption of a great idea. (Vanguard Blog)

The paradox of dumb money. (Reformed Broker)

Cheap ETFs provide an almost free lunch. (Abnormal Returns)

In pursuit of mediocrity or the high cost of active management. (Abnormal Returns)

Peace of mind and active management do not go together. (Abnormal Returns)

Three simple index portfolios. (Rick Ferri)

If you only know 5 things about investing, make it these. (Motley Fool)

In praise of doing very little. (Abnormal Returns)

In complex world, investing should be simple. (CBS Moneywatch)

Conventional investing in a complex world. (Journal of Investing)

Choosing simplicity in the new year. (Abnormal Returns)