Quote of the day

Tom Brakke, “An investment committee’s role should be clear to all.” (the research puzzle)

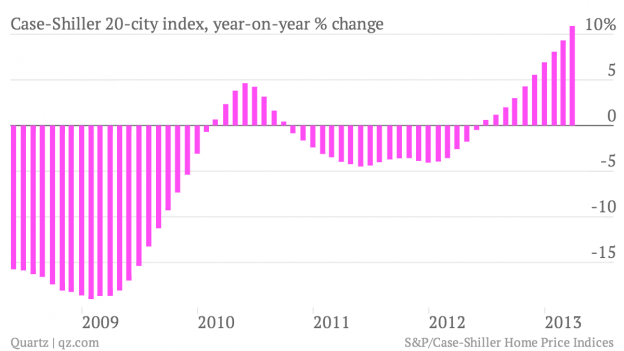

Chart of the day

The housing recovery is real. (Quartz)

Markets

Is it finally time to look at the gold miners and Apple ($AAPL). (Market Anthropology)

Falling inflation is at odds with rising stock prices. (Pragmatic Capitalism)

Seasonal tendencies are not static. (Quantifiable Edges)

Is the market’s “new, new paradigm” built on unrealistic assumptions? (MoneyBeat)

Strategy

A look at the various explanations of the low vol effect. (SSRN via Falkenblog)

Beware sideways markets. (Vitaily Katsenelson)

The heavy toll of investment fees. (Rick Ferri)

Ernest P. Chan’s Algorithmic Trading: Winning Strategies and Their Rationale is not for the casual reader. (Reading the Markets)

Companies

To disrupt an industry you have to understand it first. (Pando Daily)

Sony ($SNE) is a entertainment company not an electronics company. (NYTimes)

Finance

Time for a new way to pay hedge fund managers. (Big Picture)

This “macro tourist” cost his alma mater millions in a wrong-way bet on gold. (Clusterstock)

ETFs

ETF managed portfolios are making the leap from retail to institutional. (Pensions & Investments)

Tax efficiency comes in many forms. (InvestmentNews)

Currency hedged ETFs will work until they don’t. (IndexUniverse)

Investors continue to pour money into balanced funds. (Bloomberg)

Global

The youth unemployment problem in Europe is epic. (Money Game)

Weak air cargo volumes point to Asian weakness. (Sober Look)

Economy

What will happen to markets when QE ends? (Gavyn Davies)

The Fed is focused on market expectations about the pace of QE. (MoneyBeat)

Housing prices, per Case-Shiller, are up 10%+ in the last year. (Calculated Risk, ibid)

Commodities

Lower commodity prices are providing an economic tailwind. (WSJ)

Coal is making a bit of a comeback. (Wonkblog)

Earlier on Abnormal Returns

Financial innovation for once works FOR the individual investor. (Abnormal Returns)

Peace of mind and active management do not go together. (Abnormal Returns)

The mirage that is financial literacy: a closer look at Helaine Olen’s Pound Foolish: Exposing the Dark Side of the Personal Finance Industry. (Abnormal Returns)

Work

Doing what is meaningful vs. doing what you love. (WSJ)

How to hire good people as opposed to nice people. (Quartz)

“The Internship” stars Google ($GOOG) and some guys named Vince Vaughn and Owen Wilson. (New Yorker)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.