Quote of the day

Noah Smith, “No matter how much we might wish they were, economists are not go-to experts who know just how the world works or how to fine tune it. They are not car mechanics. And if they act like they are car mechanics, you should instantly be suspicious.” (The Atlantic)

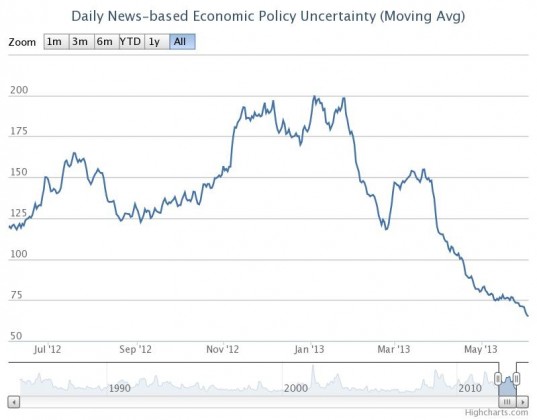

Chart of the day

Where did all the policy uncertainty go? (Wonkblog)

Markets

The advance-decline line is cooling off. (The Reformed Broker)

Individual investors are coming back to stocks. (Pragmatic Capitalism)

Where did all the stock splits go? (MoneyBeat)

How has the performance of the 100 largest ETFs done year-to-date? (ETF Replay)

Why is everyone so quick to make a call based on one month’s performance? (Mark Hulbert)

Is consumer confidence indicative of anything? (A Dash of Insight)

Why interest rates are rising. (Buttonwood)

Strategy

We build up mechanical investing strategies just to knock them down again. (The Reformed Broker)

Trading mistakes are an inevitability. (Brian Lund)

In praise of optimism. (Motley Fool)

Beware of headlines that claim to explain markets. (AdvisorOne)

Especially ones that ignore recency bias. (Pragmatic Capitalism)

It’s tough to know “where coincidence ends and causality begins.” (Adam Warner)

Companies

Amazon ($AMZN) is getting into the grocery business. (Reuters, Slate)

What is Salesforce.com ($CRM) going to do with ExactTarget ($ET)? (GigaOM)

It’s hard to see how things get a lot better for Zynga ($ZNGA). (Slate, Buzzfeed)

Why Wall Street isn’t all that keen about Facebook ($FB). (Wired)

Putting Dell ($DELL) out of its misery. (Dealbreaker)

Finance

Symthetic CDOs are back, baby. (WSJ)

Hedge funds are envious of those firms with ‘permanent capital.’ (Businessweek)

Quant hedge funds are taking a hit on bonds. (FT)

Algorithmic investment managers Betterment and Wealthfront are capturing assets. (Quartz, Wealthfront)

Where is all that M&A activity? (Sober Look)

ETFs

A guide to free ETF trading. (Morningstar)

Vanguard’s international bond funds have launched. (IndexUniverse)

High yield vs. bank loan funds: which is better? (LearnBonds)

Global

What does anyone ever invest in emerging market equities? (research puzzle pix contra iShares Blog)

Frontier markets are beating the pants off of the rest of the emerging markets. (beyondbrics)

Economy

ADP payroll numbers were okay, at best. (Capital Spectator, Wall Street Social)

ISM services shows continued expansion. (Calculated Risk, Bespoke)

More signs of weakness in manufacturing. (Real Time Economics)

Three myths about the housing recovery debunked. (Real Time Economics)

Are markets so out of control that QE needs to be reeled in? (It’s Not That Simple)

Earlier on Abnormal Returns

The media has turned on the low vol effect. Should you? (Abnormal Returns)

Mixed media

A review of Bloomberg Black. (I Heart Wall Street)

Kickstarter is tightening things up a bit. (Quartz)

Why a college education is getting more expensive. (Slate)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.