Quote of the day

Ashby Monk, “The sad reality, however, is that fees and expenses tend to be one of the more overlooked aspects of institutional money management. (Institutional Investor)

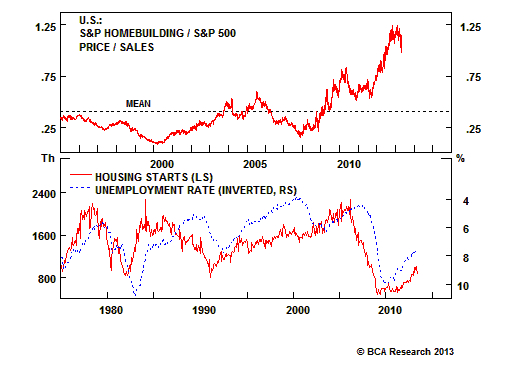

Chart of the day

Are the homebuilding stocks ahead of themselves? (BCA Research)

Markets

The US dollar and stocks are moving together of late. (Bespoke)

The yield curve has steepened. (StockCharts Blog)

Hot money is gushing out of junk bond funds. (FT, Income Investing)

Are some funds going to blow up based on the big Japan reversal? (Buttonwood)

The rush to risk is over for now. (FT Alphaville)

A bullish sign for oil equities. (Charts etc.)

Strategy

Building a better moving average. (Empiritrage)

Why you need a ‘trading cave.’ (StockCharts Blog)

Is there an explanation for the ‘Sell in May’ phenomenon? (Brett Arends)

Low risk investing without industry bets. (SSRN via Pragmatic Capitalism)

Physics is not the right model for Wall Street: a review of James Owen Weatherall’s The Physics of Wall Street. (Aleph Blog)

Companies

What is Apple ($AAPL) spending all that money on? (Minyanville)

France Telecom ($FTE) is cheap. (SumZero)

Finance

The number of TBTF institutions keeps growing. (Economist)

Q2 is shaping up well for the investment banks. (MoneyBeat)

John Paulson wants you to stop talking about his big gold bet. (WSJ)

Global

Japan’s national pension fund is loading up on stocks. (WSJ, Bloomberg)

The ECB is reluctant to go negative. (Gavyn Davies)

Canada had a blowout employment report for May. (Globe and Mail)

Economy

The May NFP report shows a healthy jump in unemployment. (Calculated Risk, Quartz, Capital Spectator, Real Time Economics, Wonkblog, Daniel Gross, Tim Duy, FT Alphaville)

What kind of jobs growth do we need to keep the unemployment rate flat? (Real Time Economics)

The mortgage refi boom is likely over. (FT Alphaville)

Earlier on Abnormal Returns

Asset allocation and the challenge of avoiding tunnel vision. (Abnormal Returns)

Mixed media

Startups are increasingly advertising on television. (Pando Daily)

A good library is filled mostly with unread books. (Farnam Street)

Why no one reads to the end of articles online any more. (Slate)

The (music) world still needs human editors. (Fast Company)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.