Quote of the day

Ali Meshkati, “Allowing any and all forms of information to enter the mind on a continuous basis is a modern day malady that will not only degrade investment results but human results.” (Zenpenny)

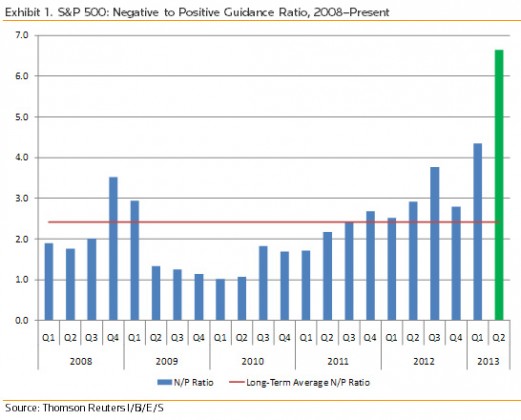

Chart of the day

Negative earnings guidance soared in Q2. (AlphaNow)

Markets

Low vol strategies were crushed in May. (Falkenblog)

The bear case for equities: signs of growing risk aversion. (Humble Student)

Adaptive trading systems have changed the market. (Price Action Lab via @chicagosean)

Meredith Whitney, “I never focused on the municipal bond market. I more focused on state arbitrage if anything.” (Bond Buyer)

Strategy

Volatility isn’t the enemy. (WSJ)

The 3 worst financial predictions of the past 5 years. (Pragmatic Capitalism)

Buy cheap stuff (around the world). (Turnkey Analyst)

What I Learned Losing a Million Dollars by Jim Paul and Brendan Moynihan is definitely worth a read. (Reading the Markets)

Taxes

In what kind of account should you hold MLPs? (WSJ)

The challenges of taxes in retirement. (Rick Ferri)

Companies

Booz Allen Hamilton ($BAH) has a huge PR problem (among other things). (Daniel Gross, CNNMoney)

Google ($GOOG)+Waze is unbeatable. (Quartz, WSJ)

Finance

Hedge fund advertising is coming. Pay no heed. (Economist)

Hedge fund of funds are hanging on by a thread. (FT)

Are money market mutual funds going to be fixed before the next crisis? (Chuck Jaffe)

Economy

Just how big is the equity market-related wealth effect? (FT Alphaville)

The US economic expansion is slow but steady. (Bloomberg)

Japan was growing at a 4.1% rate in Q1. (FT, Bloomberg)

Earlier on Abnormal Returns

Does the US need a mandatory retirement savings program? (Abnormal Returns)

I was recently a guest on Andrew Horowitz’s The Disciplined Investor podcast. (TDI)

Mixed media

Where did all the startups go? (Points and Figures)

Want to be more productive? Get more sleep. (FT)

When did sunscreens get so complicated? (Slate)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.