Keep up with all of our posts by signing up for our daily e-mail. Thousands of other readers already have.

Quote of the day

Paul Pertusi, “We live in the land of opportunity. This fact has never been more true in our history, yet ironically it has never been more doubted.” (Thoughtful Bull)

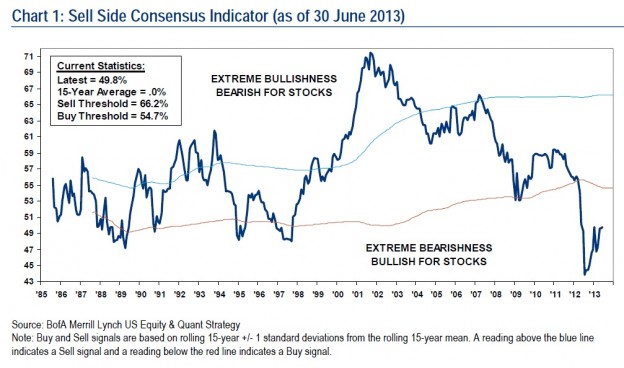

Chart of the day

Sell side strategists still have little love for equities. (Big Picture)

Markets

Historical gold market relationships have blown up. (Dynamic Hedge)

The Manufacturing PMI tracks S&P 500 revenues pretty well. (Dr. Ed’s Blog)

“Day traders” is a misnomer. (SMB Training)

Companies

If Windows Phone fails, Nokia ($NOK) has no Plan B. (Quartz)

Jim Chanos is still short Hewlett Packard ($HPQ). (Institutional Investor)

Why ‘say on pay‘ failed? (NetNet)

Finance

Citigroup ($C) is for now the kind of the cash management business but competition looms. (Reuters)

Will mobile payments ever become mainstream? (ReadWrite via Felix Salmon)

Why jumbo mortgage rates have fallen. (Dealbreaker)

ETFs

The ETF industry is desperately seeking new product ideas. (WSJ also Focus on Funds)

Why the Winkelvii will/should fail in their Bitcoin ETF attempt. (Felix Salmon, Bloomberg, The Atlantic)

A look at recent ETF withdrawals. (FT Alphaville)

ETF statistics for June 2013. (Invest with an Edge)

Global

Charting the decline in the BRICs. (VIX and More)

The risks to the Toronto condo market. (Globe and Mail)

Economy

Rising domestic oil production provides US policy makers with some flexibility. (WSJ)

A key part of Obamacare, employer mandates, gets delayed. (Quartz, Washington Post)

Weekly initial unemployment claims are moving sideways. (Calculated Risk, Bespoke)

More positive employment trends. (ValuePlays, Capital Spectator)

Checking in on the state of the US economy. (Wonkblog)

Vehicle sales are almost back to pre-recession levels. (Bonddad Blog)

Earlier on Abnormal Returns

What you may have missed in our Tuesday linkfest. (Abnormal Returns)

Mixed media

How to get better at e-mail. (Quartz)

Americans are increasingly becoming “fast cleaners.” (WSJ)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.