Quote of the day

John D. Rockefeller, “Do you know the only thing that gives me pleasure? It’s to see my dividends coming in.” (Crossing Wall Street)

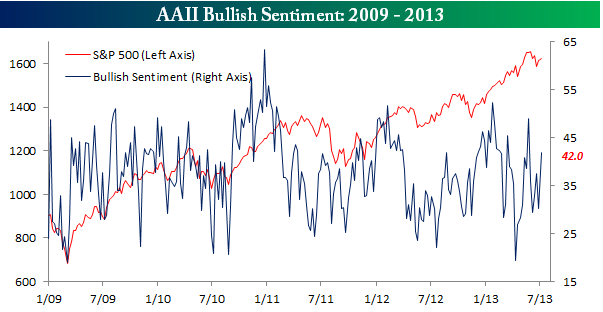

Chart of the day

Individual investors are once again getting bullish. (Bespoke)

Markets

Ten things to look for the second half of the year. (The Reformed Broker)

Fund managers are still feeling the pinch of higher stock prices. (Joe Fahmy)

How to take advantage when weird things happen to ETF prices intraday. (IndexUniverse)

Strategy

Charts aren’t bullish or bearish: people are. (Price Action Lab)

How to trade the last hour of the day. (StockCharts Blog)

Shorting based on valuation is tough. (Bronte Capital)

Companies

What is Yahoo! ($YHOO) going to do with the passel of startups it has purchased? (Pando Daily)

Can JC Penney ($JCP) get its old, albeit tired, mojo back? (Slate)

Is Amazon ($AMZN) finally easing up on discounts? (NYTimes)

Hedge funds

How hedge funds did in June. (MoneyBeat)

One fund manager is betting that the long bull market in mortgage securities is at an end. (WSJ)

Global

The long term case against a single European currency. (Free exchange)

The world’s central bankers now all give forward guidance. (Gavyn Davies)

Economy

June’s employment report shows stronger than expected growth. (Calculated Risk, Quartz, Daniel Gross, Capital Spectator, RTE, Economix. Bonddad Blog)

In a certain respect the US economy is on its own. (Felix Salmon)

States wish they had another year to implement Obamacare. (Washington Post)

Earlier on Abnormal Returns

What you may have missed in our Thursday linkfest. (Abnormal Returns)

Careers

What NOT to do in job interviews. (Aleph Blog)

Should Oregon fund college though career equity? (Marginal Revolution)

What Americans work in the Amazon’s Mechanical Turk program? (Priceonomics Blog)

A review of Mastery by Robert Greene. (Frank Voisin)

Mixed media

Why Google ($GOOG) really killed Google Reader. (Marco Ament via Fast Company)

Which makes for better grilling: gas or charcoal? (Wired, ibid)

What the rise or “Hick Hop” tells us about the state of the music business. (WSJ)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.