Quote of the day

Daniel Gross, “Money managers who excel in one economic period won’t necessarily excel in another. Even steely contrarians like Paulson and Einhorn can get caught up in fads. And all that’s gold doesn’t glitter.” (The Daily Beast)

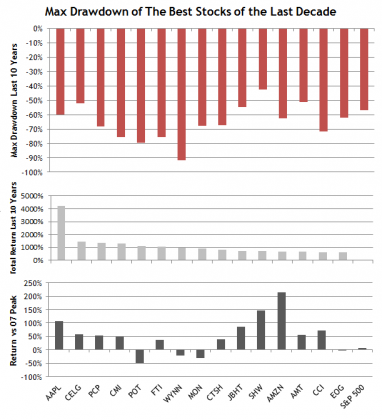

Chart of the day

Even the best performing stocks of the past decade had big drawdowns. (Avondale Asset)

Markets

August and September are not not so hot historically for the stock market. (All Star Charts)

Now that the VIX is a traded asset is it no longer useful as a sentiment indicator? (Reuters)

What is going on with gold lease rates? (FT Alphaville)

Strategy

Holding cash is guaranteed to lose you money. (Pragmatic Capitalism)

Complex markets don’t necessarily require complex responses. (the research puzzle)

Why factor investing matters. (SSRN via @researchpuzzler)

A look at Mark Wolfinger’s The Rookie’s Guide to Options: The Beginner’s Handbook of Trading Equity Options. (Reading the Markets)

Companies

A stronger dollar is taking a toll on US multinational earnings. (Bloomberg)

The App Store’s biggest winners and losers. (SplatF)

Is the Netflix ($NFLX) model the future of e-books? (Marketwatch)

Not all web traffic is created alike. (Pando Daily)

Finance

How did Markit get so big? (Economist)

Hedge funds can now advertise. (Term Sheet)

Why activist investors should get a little bit more respect. (Dealbook)

Insurance companies can’t afford to be ideological. (Daniel Gross)

Banks should thank their lucky stars they can’t buy back more shares. (Dealbreaker)

ETFs

Blackrock ($BLK) continues to add to its target date bond ETF lineup. (InvestmentNews)

A breakdown of the iPath S&P 500 VIX Short-Term Futures ETN ($VXX). (Adam Warner)

The ETF Deathwatch for July 2013. (Invest with an Edge)

Global

Chinese trade data points to a much deeper dip. (FT Alphaville, FT)

A look at Chinese financials. (Humble Student)

Economy

Why jobless claims data matter. (Capital Spectator)

The Fed looks at more labor statistics than the unemployment rate. (Real Time Economics)

The US employment situation is still abnormal. (Sober Look)

Earlier on Abnormal Returns

There is no such thing as emotionless investing. (Abnormal Returns)

What you may have missed in our Tuesday linkfest. (Abnormal Returns)

Mixed media

What is America’s new favorite berry? (WSJ)

Put down that glass of skim milk. (Scientific American)

In search of a more perfect broccoli. (NYTimes)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.