Quote of the day

Ivanhoff, “The best performing stocks in any given year are the ones that surprise the most, which means that they are very likely to come from industries no one expects.” (Ivanhoff Capital)

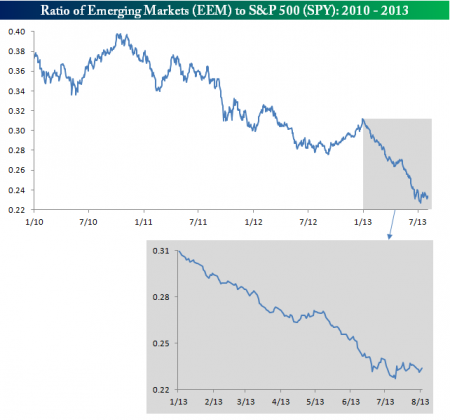

Chart of the day

Have the emerging markets stabilized relative to the US? (Bespoke)

Video of the day

Jason Zweig talks with Consuelo Mack about the chase for yield. (Wealthtrack)

Markets

Major asset class performance for July 2013. (Capital Spectator)

Rydex investors are not jumping on this rally. (StockCharts Blog)

A look at market breadth. (StockCharts Blog)

The week ahead is light on data. (A Dash of Insight)

Some times it is better to be lucky than good. (Bronte Capital)

Strategy

Are you willing to precommit to the stock market? (Jason Zweig)

Quality matters when it comes to picking stocks. (FT)

The market timing myth: you need to be all-in or all-out of the market. (Forbes)

Most investors don’t hang out online debating investment strategies. (Random Roger)

Commodities are not the portfolio diversifiers many think they are. (voxEU)

Companies

Ten days that changed mobile stocks. (TheStreet)

The television industry is not going to give up without a fight. (Barron’s)

Yahoo! ($YHOO) is singlehandedly relieving the Series A crunch, including a purchase of Rockmelt. (Pando Daily, Wired)

Finance

Private equity is selling into “robust markets” not buying. (Bloomberg)

On the private gains and public costs of high frequency trading. (Rajiv Sethi)

If you can’t do an IPO now, when can you do it? (Barron’s)

Passive investors are “parasites” on the body finance. (FT)

Economy

A look at the week’s economic reports. (Bonddad Blog)

The economic schedule for the coming week. (Calculated Risk)

Earlier on Abnormal Returns

What you may have missed in our Saturday linkfest. (Abnormal Returns)

Top clicks this week on the site. (Abnormal Returns)

Mixed media

How to fix the ebook market. (Digitopoly)

Men and women gauge risk differently. (Scientific American)

The month of August sucks. Bring on September. (Slate)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.