Quote of the day

Barry Ritholtz, “We do not know if equities are either over or under valued, because we have no idea what future earnings are going to be. The debate about valuations often turns on which group’s forecast is going to be correct: Expansion or contraction.” (Big Picture)

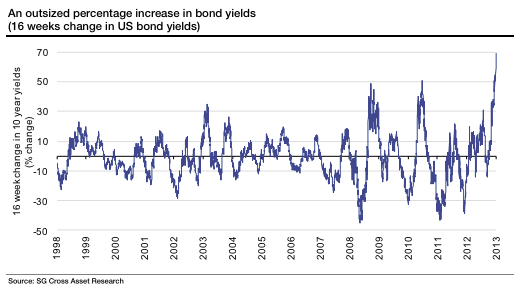

Chart of the day

Check out just how big the spike in bond yields has been historically. (FT Alphaville)

Markets

Stock correlations are at levels not seen since before the financial crisis. (Condor Options, WSJ)

Signs of late cycle rotation. (Humble Student)

Half of S&P 500 stocks are above their 50-day moving average. (Bespoke)

Take heed of weak emerging markets. (RiskReversal also Bloomberg)

Why has the market performed relatively poorly in September? (HedgeWorld)

Strategy

Carl Icahn doesn’t give a s*#t what you think. (Joe Fahmy)

Fine art indices are inherently flawed. (Economist)

A short history of factor investing. (Rick Ferri)

Just how sensitive are momentum strategies to the starting day. (SSRN via @quantivity)

Bill Ackman

What hath Bill Ackman wrought at JC Penney ($JCP)? (Buzzfeed Business)

Is the Bill Ackman bashing overdone? (The Reformed Broker)

Companies

How iTunes Radio will shake up streaming music. (Techland)

LinkedIn ($LNKD) wants to attract college kids. (GigaOM)

Bank loans

The bank loan market is shedding covenants. (FT)

New investors are also making loans more volatile. (Bloomberg)

Startup funding

Is crowdfunding an alternative to a world awash in capital? (FT)

Startups looking to raise money are facing a slew of new SEC disclosure rules. (TechCrunch)

Institutional investors

Public pension funds are self-managing more of their funds. (Dealbook)

Institutional investors are getting into the ETP funding and seeding game. (Pensions & Investments)

Fossil fuel divestment campaigns are gaining ground. (Institutional Investor)

ETFs

Should investors take a look at the reopened Fairholme Fund? (Focus on Funds)

Charles Schwab ($SCHW) is entering the smart beta ETF space. (TheStreet)

Global

Indonesian stocks (and the rupee) got crushed today. (FT Alphaville,

How Ireland got duped into guaranteeing all bank liabilities post-crisis. (WashingtonPost)

Why are Chinese home prices continuing to rise? (Quartz)

Economy

US manufacturing is regaining lost ground. (WSJ)

The mortgage refinancing boom is over. (Sober Look)

Rail traffic picks up some momentum. (Pragmatic Capitalism)

Earlier on Abnormal Returns

What you may have missed in our Sunday linkfest. (Abnormal Returns)

Mixed media

Twitter is becoming a mainstream investment tool. (The Fiscal Times)

No one is under any obligation to read what you write. (Krugman via Weisenthal)

How is the new Digg doing? (GigaOM)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.