Quote of the day

Erik Swarts, “What’s the difference between a geologist and an engineer? An engineer doesn’t understand mud.” (Market Anthropology)

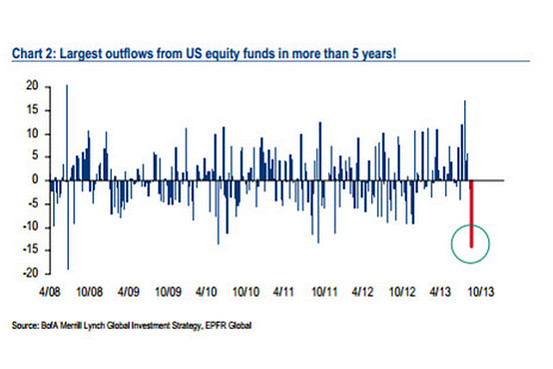

Chart of the day

Investors are once again dumping equity funds. (MoneyBeat)

Markets

Fund managers are starting to add to commodities. (The Short Side of Long)

A look at the handful of undervalued industries. (Aleph Blog)

Treasury yields could still back up another 100 bp. (Sober Look)

Strategy

Why fear sells. (A Dash of Insight)

Lying with performance graphs. (Rekenthaler Report)

Momentum works even in government bonds. (Larry Swedroe)

Companies

Target ($TGT) has a funny definition of “earnings.” (Jeff Matthews)

Why Steve Ballmer failed. (New Yorker, Pogue, Dumb Money)

The risk to home builders. (Sober Look)

Global

Mark Mobius makes the case for the oversold emerging markets. (LinkedIn)

Why Indonesia remains vulnerable. (Sober Look)

Economy

Why the Fed should be buying MBS not Treasuries. (FT Alphaville, Wonkblog)

What sort of return should savers expect? (Noahpinion)

A look back at the week in economic statistics. (Bonddad Blog)

The economic schedule for the coming week. (Calculated Risk)

Earlier on Abnormal Returns

Top clicks this week on Abnormal Returns. (Abnormal Returns)

What you may have missed in our Saturday linkfest. (Abnormal Returns)

Autos

Uber aims to be more than just a car service. (Business Insider)

Tesla ($TSLA) has 12% of the California luxury car market. (ArsTechnica)

Google ($GOOG) may want to build self-driving cars on its own. (Quartz)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.