Quote of the day

Morgan Housel, “The business model of the majority of financial services companies relies on exploiting the fears, emotions, and lack of intelligence of customers. The worst part is that the majority of customers will never realize this.” (Motley Fool)

Chart of the day

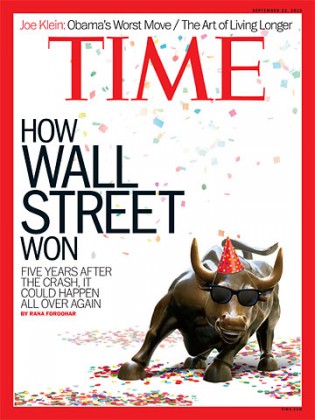

Should we worried by this magazine cover? (Time, StockTwits Blog, BI)

Markets

Four reasons for a short-term bond rally. (Pragmatic Capitalism)

Should we be worried that stock correlations have dropped? (Adam Warner, Unexpected Returns)

Three generational market lows compared. (Big Picture)

Two observations doth not a trend make. (A Dash of Insight)

Rule #1 for investing in IPOs: don’t invest in IPOs. (Slate)

Apple

Is Apple ($AAPL) being “short-term greedy”? (Henry Blodget)

Apple is laying the groundwork for bigger stuff down the road. (Canny Vision via DF)

Twitter IPO

Twitter “secretly” files for an IPO. (WSJ, FT, Dealbook)

Twitter is a 2013 IPO. (Term Sheet)

Why the timing of the MoPub acquisition is no coincidence. (Quartz)

Where Twitter is trading on private markets. (Business Insider)

Which investors are going to make out in a Twitter IPO? (UpsideTrader)

Facebook IPO redux: GSV Capital ($GSVC) and Firsthand Technology Value ($SVVC) run up on the news. (MoneyBeat)

What Twitter has learned from the Facebook ($FB) IPO. (Pando Daily)

Just what is a confidential S-1? (Dealbook)

Twitter the company

The Twitter experience is changing as it attempts to grow and become more mainstream. (New Yorker)

Does Twitter have a growth problem? (AllThingsD)

Dick Costolo proves that founders are not necessarily the best leaders of a company. (Pando Daily)

Lehman

How would a Lehman bankruptcy be handled today? (Breakingviews)

Why Lehman mattered. Markets were surprised it wasn’t bailed out. (macroresilience)

It has cost $3 billion to wind up Lehman Brothers to-date. (FT)

Finance

We are in year five of money market fund reform. (FT Alphaville)

Mainstream Wall Street analysts don’t like upstarts messing with their stocks. (Quartz)

ETFs

The financial crisis will soon be erased from five-year fund track records. (Chuck Jaffe)

How does Vanguard select active managers? (Vanguard)

Global

Investors officially hate the BRICs. (Bloomberg)

If world population starts shrinking what does it mean for the global economy? (FT Alphaville)

Economy

Retail sales growth slowed in August. (Capital Spectator, Calculated Risk, Bespoke)

Where’s inflation gone? (Charts etc.)

How the financial crisis has further divided America politically. (Free exchange)

Earlier on Abnormal Returns

What you may have missed in our Thursday linkfest. (Abnormal Returns)

Mixed media

On long-term blogging. (Aleph Blog)

In case you have not yet seen the documentary Floored about the demise of floor traders in Chicago. (Futures)

Felix Salmon has a rave review for Tim Harford’s The Undercover Economist Strikes Back. (New Statesman)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.