Quote of the day

Ashby Monk, “Investment professionals too often forget that a dollar saved in costs or fees is actually worth more than a dollar earned from investment returns (thanks to taxes).” (Institutional Investor)

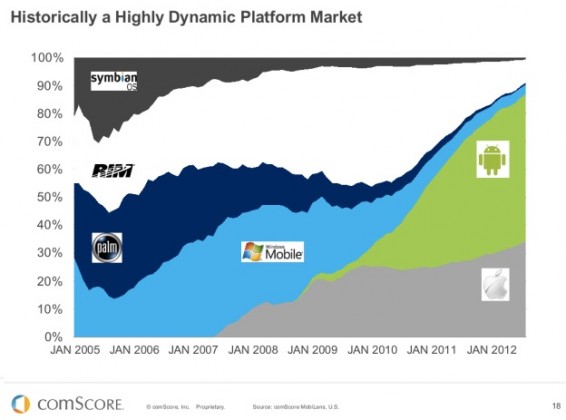

Chart of the day

The decline of Blackberry ($BBRY) in one chart. (The Switch)

Markets

Some notable divergences include homebuilders and financials failing to make new highs. (The Short Side of Long)

The Fed’s non-taper has put a charge in interest-rate sensitive stocks. (StockCharts Blog)

Trying to analyze Washington from an investment-perspective these days is kind of sad. (A Dash of Insight)

Strategy

Just because a financial advisor claims they are ‘fee only‘ does not mean that they are. (Jason Zweig)

Is your portfolio just a pile of parts? (Canadian Couch Potato via @monevator)

Why do investors fail using valid strategies? (Aleph Blog)

On the interests of the crowd pushing bonds as a “safe investment.” (Simon Lack)

How B/P explains future country returns. (SSRN via @quantivity)

Funds

Big money is buying up single-family homes. What gives? (The Atlantic)

Investors just can’t seem to get their timing on tactical funds correct. (The Reformed Broker, WSJ)

Global

The window is open to emerging market bond issuance. (beyondbrics)

The opportunity in Indian stocks. (Unexpected Returns)

Economy

The task facing a Yellen-led Fed. (Politico)

Why are consumers so inflation-focused? (Sober Look)

A look back at the economic week that was. (Bonddad Blog)

The economic schedule for the coming week. (Calculated Risk, Turnkey Analyst)

Earlier on Abnormal Returns

Top clicks this week on the site. (Abnormal Returns)

What you may have missed in our Saturday linkfest. (Abnormal Returns)

iPhones

Why upgrading your iPhone is good for the poor. (WSJ)

The opportunity cost of buying cronuts and iPhones. (Ben Walsh)

How much electricity does a smartphone use? (ClimateProgress)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.