Quote of the day

TBI, “It’s important to remember, though, that just because the market level is not cheap doesn’t necessarily mean that you shouldn’t own stocks! It’s nice to buy stocks when the market is really cheap for sure, but that has only happened very rarely in history.” (The Brooklyn Investor)

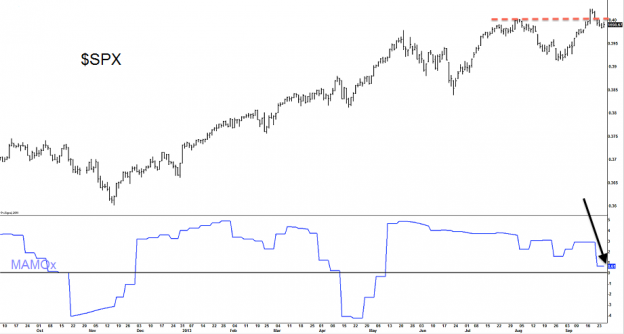

Chart of the day

On the growing prospect of a good old fashioned correction. (Dynamic Hedge)

Markets

Bottoms don’t happen in a day. (Market Anthropology)

Are S&P 500 profit margins really all that high? (Term Sheet)

US companies are still pumping out higher dividends. (FT)

Putting the value of the $VIX into perspective. (Adam Warner)

A negative breadth divergence in the health care sector. (The Short Side of Long)

Strategy

There’s a fine line between hubris and overconfidence. (Phil Pearlman)

How does this “ancient asset allocation strategy” perform these days? (Mebane Faber Research)

ON the difference between shallow and “deep” risks. (Rekenthaler Report)

Should you share (or follow) your trades on social media? (The Kirk Report)

Your market forecasting record sucks. Just stop already. (Big Picture)

Why rebalancing works. (Larry Swedroe)

Books

A brief overview of John Mihaljevic’s The Manual of Ideas: The Proven Framework for Finding the Best Value Investments. (Turnkey Analyst)

Need an intro to frontier markets? Investing in Frontier Markets: Opportunity, Risk and Role in an Investment Portfolio by Gavin Graham and Al Emid gets the job done. (Reading the Markets)

The Playbook: An Inside Look at How to Think Like a Professional Trader by Mike Bellafiore is still free for the Kindle. (SMB Training)

Finance

Why would anyone buy CDS on US government debt? (Matt Levine)

Why is SecondMarket mucking about with Bitcoins? (Felix Salmon)

Why buy private equity when you can actively invest in microcaps? (All About Alpha)

Funds

The managed futures malaise is historically bad. (Attain Capital, ibid)

On the role of bond funds in a portfolio. (A Dash of Insight)

Don’t look now but bond funds are having a good quarter. (WSJ)

Vanguard is getting in on the low vol trend. (Focus on Funds)

Global

19 charts to restore your faith in the global economy. (Quartz)

European corporate profit margins are stabilizing. (FT Alphaville)

Do you really want to bet against China? (HBR)

Money is flowing back into emerging market bond funds. (MoneyBeat)

Economy

Justin Wolfers, “Right now, the risk of deflation is greater than the risk of explosive inflation.” (Bloomberg)

Jobs are getting less hard to get. (Dr. Ed’s Blog)

Want to control the Fed? Run the meetings. (Planet Money)

Earlier on Abnormal Returns

Financial innovation waits for no one: the case of angel investing. (Abnormal Returns)

What you may have missed in our Tuesday linkfest. (Abnormal Returns)

Mixed media

Hacked fingerprints are not a real-world iPhone problem. (Pogue)

Stay weird, Twitter. (WSJ)

Twitter is “little more than a silly messaging system.” (The Epicurean Dealmaker)

Thanks for checking in with Abnormal Returns. You can follow us on StockTwits and Twitter.